Understanding the impact of Gross vs Net Revenue on your business strategy

Revenue ≠ Profitability. Many SaaS leaders see a fast-growing revenue “top line” and assume the business is flourishing, but in reality revenue alone doesn’t equal profit. A common blind spot is misunderstanding the difference between gross revenue and net revenue – and this can lead to strategic missteps. If you only focus on gross revenue, you might be flying blind to costs or deductions that eat into what your company actually keeps. This article aims to clear up the definitions of gross vs. net revenue, highlight why the distinction matters, and empower you to make smarter decisions based on the right metrics at the right times.

Gross vs. Net Revenue: clear definitions for SaaS

To start, let’s clearly define gross revenue vs net revenue in a SaaS context:

- Gross Revenue (Definition): Gross revenue is the total revenue generated from all sales of subscriptions or services before any deductions. It represents all customer payments at full value – essentially the sum of all invoices or subscription fees billed in a period. Gross revenue is often called top-line revenue and shows your business’s total sales ability (e.g. the total contracted value in SaaS) but not the costs or concessions associated with those sales.

- Net Revenue (Definition): Net revenue (also known as net sales) is the revenue that remains after subtracting any discounts, refunds, credits, chargebacks, or fees related to those sales. In other words, net revenue is what your company actually retains from its customers once you account for things like promotional discounts, customer refunds, and revenue-sharing with partners. This figure provides a more accurate view of income and is typically the number you would report just below gross revenue on an income statement. (Note: Net revenue is not the same as net income or profit – net income subtracts all operating expenses, whereas net revenue only accounts for sales-related deductions.)

Quick example: Imagine your SaaS company billed $1,000,000 in subscription sales this year (gross revenue). However, you gave $100,000 in discounts to win deals, issued $50,000 in refunds for cancellations or customer churn, and paid $50,000 in commissions or marketplace fees to partners. After these adjustments, your net revenue would be $800,000. This means out of the $1M gross sales, only $800k was actually kept by your business once discounts, refunds, and partner cuts were accounted for. The example illustrates how gross vs. net revenue can diverge significantly – in this case, the net revenue is only 80% of the gross.

The table above provides a simple gross vs net revenue example for a SaaS business. Gross revenue reflects the demand and sales volume, while net revenue shows the actual value the company retains. Next, we’ll explore why this distinction is so important in practice.

Why this distinction matters in practice?

In day-to-day SaaS operations, a lot can happen between gross and net revenue. Here are some common factors that cause net revenue to be lower than gross revenue:

- Discounts and promotions: Price discounts (e.g. 20% off for annual plans, coupon codes, etc.) directly reduce the revenue you actually earn from each sale. For instance, selling a subscription listed at $100 for $80 means your gross revenue counted $100, but net revenue is only $80. Frequent or heavy discounting can create a large gap between gross and net revenue – a sign of aggressive sales tactics that cut into margins.

- Refunds and chargebacks: If customers cancel and get refunds, or if there are chargebacks, those sales are essentially reversed. Any refunded amount is subtracted from revenue. So if your SaaS had $20,000 in monthly sales but issued $2,000 in refunds, your net revenue is $18,000 for that month. High refund rates (perhaps due to customer churn or dissatisfaction) will shrink net revenue relative to gross.

- Payment processing fees: Every transaction has payment processing costs (credit card fees, payment gateway fees). These fees, usually on the order of ~2-3% of the transaction, mean you don’t get to keep the full customer payment. For example, on a $100 customer payment via credit card, you might pay about $1.97 in fees and only receive $98.03 net. While these fees are often recorded as expenses rather than deducted from revenue in accounting, from a practical standpoint they reduce the cash you net per sale.

- Reseller or partner cuts: SaaS businesses that sell through resellers, app marketplaces, or affiliate partners often give up a percentage of each sale. In such revenue-sharing arrangements, your gross revenue might reflect the full customer payment, but your net revenue is only the portion you keep after the partner’s commission. For example, if you sell via a marketplace that takes a 30% cut, a $100 sale is $100 gross but only $70 net to you. Platforms like Uber and Airbnb illustrate this principle on a massive scale – Uber’s gross bookings in Q4 2023 were about $38 billion, but Uber’s net revenue (after paying drivers their share) was only about $9.9 billion. In accounting terms, Uber only recognizes the net commission as revenue, since the drivers are effectively the “cost” of that revenue. The same concept applies to SaaS channel partners or referral fees: net revenue tells you what actually comes into your business’s coffers.

As you can see, there are many legitimate reasons why net revenue will be lower than gross. The problem is when companies ignore this gap. Relying solely on gross revenue can be dangerous – it can paint an overly rosy picture and hide underlying issues. For example, a business might be touting high gross sales while heavy discounting or refunds are quietly eroding its true earnings. This “vanity metric” trap means you could be scaling up sales efforts or forecasting growth based on numbers that don’t translate to actual cash or profit. In short, gross revenue can tell a very different story from net revenue, and understanding that difference is crucial to avoid strategic blind spots.

{{discover}}

Strategic implications for SaaS businesses

Getting a handle on gross vs. net revenue isn’t just an accounting technicality – it has major strategic implications for SaaS companies:

1. The “Top-Line” Illusion vs. Margin Reality

Gross revenue can create a top-line illusion – it shows growth and market traction, which is great for bragging rights or sales team morale. However, gross figures alone don’t tell you anything about profitability or unit economics. A startup could double its gross revenue year over year, but if that growth came with huge discounts or revenue-share deals, the net revenue might tell a less exciting story. Net revenue brings margin awareness into focus. It reveals how much of those sales you actually get to use to run the business. For instance, if your gross revenue is growing 50% but net revenue is only up 10%, it’s a red flag that costs or concessions are eating your growth. Healthy SaaS businesses typically have high gross margins (often ~70-90% in pure software). If your net is a much smaller fraction of gross, it means your gross margin is low – something investors and CFOs will scrutinize closely.

2. Investor perspective – Quality of revenue

In today’s market, investors and boards care about quality of revenue as much as quantity. Gross revenue might demonstrate the ability to generate sales, but savvy investors are looking at net revenue growth to gauge the sustainable, real growth of the business. An impressive top-line can quickly deflate under due diligence if a large chunk of it never turns into actual earnings. In fact, many investors now consider heavy gross-to-net adjustments (like overly high cost of sales or extensive discounts) as a risk – they prefer companies that show strong net revenue retention and efficient growth. This means a SaaS firm with $10M gross revenue and $9M net (90% net retention of revenue) will be viewed far more favorably than one with $10M gross but only $6M net (40% lost to costs, indicating thin margins or channel issues). Lower gross margin businesses get more scrutiny on their model, because it impacts valuation and the path to profitability.

3. Use cases for Gross vs. Net Awareness

Understanding the difference between gross and net revenue enables smarter strategy in several areas:

- SaaS valuation modeling: When projecting future growth or doing valuation analyses, using net revenue gives a realistic picture of cash generation. Valuation multiples (like ARR multiples) are higher for companies with strong net revenue and margins, because that revenue is more indicative of eventual profit. In contrast, gross figures can inflate expectations; models built on gross might overestimate future cash flows if the gross-to-net gap isn’t accounted for. Simply put, high net revenue (relative to gross) can lead to higher quality valuations.

- Board and investor reporting: Presenting both gross and net revenue in board decks or investor updates provides transparency and builds trust. Gross revenue shows the sales momentum, while net revenue shows the true impact on the bottom line – both matter for a complete picture. Seasoned SaaS CFOs often include a gross vs. net revenue bridge in reports. Being upfront about net revenue (and the deductions affecting it) helps avoid any confusion or surprises. Investors don’t like being wowed by a $100M “revenue” story only to find out later that $30M of it was rebates or reseller cuts. Communicating the net clearly avoids that credibility loss.

- Product pricing and discount strategy: Monitoring the gap between gross and net can inform your pricing strategy. If net revenue is lagging far behind gross, it might signal that discounts or promotions are too generous, eroding your margins. For example, if a particular product or market segment shows a 25% difference (gross vs net), finance and sales leaders may need to tighten discount policies or re-evaluate the product’s pricing. Gross revenue might tell you sales volume is great, but net reveals if those sales are actually profitable. Companies like Salesforce have shifted focus to net expansion (revenue from existing customers minus churn) rather than just gross sales growth, to ensure sales efforts are high quality.

- Go-to-Market channel optimization: Gross vs. net analysis helps in optimizing sales channels. If direct sales vs reseller sales show very different net yields, that’s actionable. For instance, selling via a reseller might boost gross sales, but if the reseller takes a 40% cut, your net per customer is much lower than a direct sale. Knowing this, you might choose to invest more in direct channels or negotiate better partner terms. If certain regions or channels consistently have a large “discount to list” ratio (i.e., a big gross-net gap), it flags an issue in your go-to-market approach. Ultimately, you want channels that maximize net revenue, not just gross.

In summary, gross revenue is useful for some things – it’s a vanity metric that’s good for measuring market demand and motivating the team – but net revenue is a sanity metric that keeps you grounded in what’s actually being earned. SaaS leaders should track both, but make strategic decisions with an eye on net.

When to use Gross vs. Net in reporting?

Both gross and net revenue have roles in business reporting, but they serve different purposes. Here are some guidelines on when to use each:

- Use gross revenue when… you want to emphasize overall sales traction or market demand:

- Internal sales performance: Gross figures can be motivational for go-to-market teams. For example, reporting that “we brought in $5 million in bookings this quarter” (gross) highlights sales hustle and market interest, regardless of discounts. It’s a way to measure total demand generation across different markets or products.

- Market size and reach: If you’re analyzing total market opportunity or the full value of transactions, gross revenue (or related metrics like GMV – Gross Merchandise Value) gives the big picture. For instance, a SaaS marketplace might track gross transaction volume to show how much value flows through the platform, even though only a fraction is taken as net revenue.

- Use net revenue when… you are focusing on financial planning, efficiency, and true business health:

- Budgeting and forecasting: Net revenue is the starting point for budgets, operational spend, and cash flow planning. Since it reflects actual money retained, it’s what you use to determine how much you can invest in hiring or product development. For example, you might have $1M gross sales, but if net is $800k, planning expenses against $1M would be a mistake – you really only have $800k before other operating costs. Net gives the realistic view for runway calculations.

- Investor communications and fundraising: When pitching to investors or reporting financials, net revenue is far more relevant for evaluating growth. Investors will discount gross figures if they’re not accompanied by net. In fact, many VCs explicitly look at net new ARR or net retention to gauge growth quality. Showing a strong net revenue growth gives confidence in the business model’s efficiency (whereas a big gross number with tiny net might raise eyebrows). If you’re structuring a financing round, metrics like Net Revenue Retention (NRR) and gross margin (which uses net revenue as the base) are key; gross alone doesn’t cut it.

- Unit economics and SaaS metrics: Core SaaS metrics require net revenue. For example, calculating gross margin requires net revenue minus cost of goods; calculating CAC payback period should use the net revenue (or contribution margin) from a customer, not just the gross sales, to see how quickly you recoup the cost of acquisition. And NRR, a crucial health metric, measures how revenue from existing customers grows or shrinks after churn/upsells – it’s inherently a net figure. Using gross revenue in these metrics would mislead you, whereas net-based calculations show the real efficiency of your model.

Example scenario: To truly appreciate why choosing the right metric matters, consider two hypothetical SaaS companies: - Company A reports $10 million in gross revenue this year and, after minimal discounts or refunds, has $9.5 million in net revenue. - Company B also reports $10 million gross, but due to heavy discounting, reseller commissions, and refunds, its net revenue is only $6.2 million.

On the surface (gross), these companies look identical – they both “sold” $10M. But in reality, Company A kept almost all of its sales value, while Company B only retained a bit over half! Their strategies and financial situations will be radically different. Company B’s lower net revenue means lower gross margins, which likely translates to a higher burn rate (because more of their sales are eaten up by costs or concessions). Investors would value these businesses very differently – in fact, if Company B had been pitching based on the $10M gross alone, an investor would be in for a nasty surprise when they discover the net is so much lower. This scenario isn’t far-fetched: one SaaS startup might tout $1M ARR gross, but if 30% of that comes off due to discounts or churn risk, the true picture (maybe ~$700k effective net ARR) is much less rosy. The lesson is clear: always know your net, and use gross and net appropriately when telling your company’s story.

Forecasting, Fundraising, and Valuation impact

Finally, let’s discuss how gross vs. net revenue impacts forecasting and valuation for SaaS companies:

- More accurate Forecasting & Unit economics: When projecting revenue growth or modeling your financial future, net revenue provides a realistic foundation. Because net revenue accounts for the money you actually get to keep, using it in forecasts leads to more accurate cash flow predictions and headcount or expense planning. It helps avoid overestimation that could happen if you assumed every dollar of gross sales is a dollar you can spend. Net revenue also feeds into key unit economics – metrics like customer lifetime value (LTV), gross margin, and payback periods all rely on the net dollars from customers. If you base these on gross, you’d be overstating how efficient or profitable your model truly is. In short, net revenue-centric forecasting keeps you honest and ensures your growth plans are grounded in reality.

- Higher-Quality Growth (and Higher Valuations): In the era of “smart growth” (as opposed to growth at any cost), investors reward companies that show they can convert gross sales into net revenue efficiently. Strong net revenue growth, coupled with healthy margins, often leads to better valuation multiples because it signals a scalable and profitable model. For example, a company with $50M gross and $45M net will generally command a higher multiple than one with $50M gross but $30M net – the former is simply a higher quality revenue stream. Investors today are increasingly focusing on metrics like net revenue retention and gross margin to assess how durable and profitable revenue is. The more of your gross revenue that “drops down” to net, the more confidence they have in your business’s ability to eventually generate earnings. As a result, SaaS valuations (whether in fundraising or even acquisitions) heavily favor those with strong net revenue figures. High gross revenue with poor net conversion might get a company in the door, but it won’t survive rigorous due diligence. In fact, misrepresenting gross as net or failing to clarify the difference has led to credibility loss and even funding issues for companies in the past.

- Avoiding the Gross Revenue Trap: Using gross revenue in pitches or planning can inflate expectations and set you up for underperformance. If a scaleup’s projections are based on gross revenue growth without factoring in the widening gap to net, they may over-invest in growth and then find actual cash flows falling short. Moreover, in fundraising, any savvy investor will adjust your gross figures to net – so you’re better off leading with net to begin with. It’s far better to show, “We made $8M net revenue from $10M gross, and here’s how we’ll improve that ratio as we grow,” than to brag about $10M and have investors later discover only $8M was real. By focusing on net, you demonstrate fiscal discipline and a clear path to profitability, which can significantly impact your company’s valuation and ability to raise capital on good terms. In essence, gross revenue tells the story of growth, but net revenue convinces others that your growth is meaningful and sustainable.

Conclusion

In the world of SaaS, gross revenue tells a story, but net revenue tells the truth. Gross revenue is the attention-grabbing number – it reflects your product’s market traction and the scale of your sales activities. Net revenue, on the other hand, reveals what those sales are truly worth after all the real-world adjustments. Both metrics matter: savvy leaders track gross vs net revenue in tandem, knowing that relying on the right one at the right time is a real competitive edge. Use gross to measure momentum, and net to measure money.

As a growth-focused SaaS leader, making decisions with a clear view of both gross and net revenue will help you avoid blind spots and allocate resources more wisely. And the good news is you don’t have to figure it all out manually. With the right tools – like Fincome – you can automatically track and analyze both gross and net revenue streams in real time, gaining full transparency into your business’s true financial performance. Such insight turns revenue reporting from a mere accounting task into a strategic driver of growth. Ultimately, understanding gross vs net revenue isn’t just about accounting definitions – it’s about steering your SaaS business with clear eyes, ensuring that strong top-line growth also translates into healthy, sustainable bottom-line results.

{{newsletter}}

Découvrez Fincome!

Questions fréquentes

Expense Tracking:

Fincome est une plateforme SaaS de pilotage des revenus spécialement conçue pour les entreprises à modèle de revenus récurrents (toutes les entreprises qui vendent de l’abonnement).

Fincome automatise le suivi et le pilotage de vos revenus et KPIs en découlant (churn, LTV, CAC…) en temps réel, sans nécessiter d’équipe data, ni de retraitements manuels, grâce à des intégrations directes avec vos systèmes de facturation et ERP.

Contrairement aux outils BI généralistes, Fincome offre une solution clé en main, intuitive, et parfaitement adaptée aux besoins spécifiques des modèles économiques par abonnement, pour collaborer efficacement entre équipes finance, GTM et CSM.

Fincome s’adresse exclusivement aux entreprises à modèle de revenus récurrents, c’est-à-dire qui vendent de l’abonnement et ont un intérêt à suivre le MRR ou l’ARR, comme :

• les éditeurs de logiciels

• les média

• les applications mobiles

• toutes autres entreprises d’abonnement B2B/B2C souhaitant professionnaliser le pilotage des revenus

Fincome répond aux enjeux des structures à toutes les étapes de la vie des entreprises, des start-ups aux ETI et grands groupes développés à l’international.

Avec Fincome, vous accédez à une suite complète de modules :

✅ Revenus : analyse détaillée de votre ARR/MRR, analyses par cohortes, détection des omissions de facturation, reconnaissance du revenu et des PCA

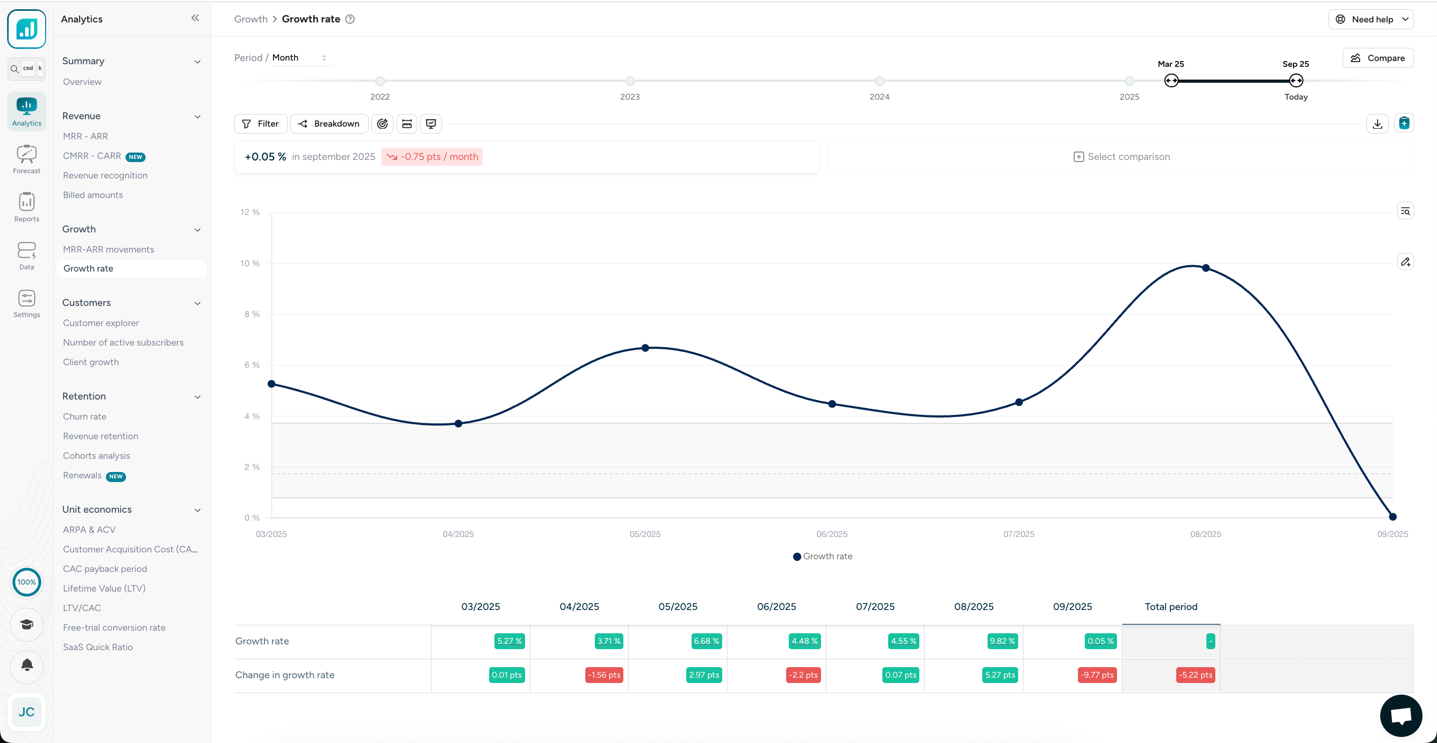

✅ Croissance : décomposition des mouvements d’ARR (new business, expansion, churn, réactivation), identification et compréhension des drivers de croissance

✅ Unit Economics : analyse de la LTV, du CAC, LTV/CAC par segment, canal ou géographie pour optimiser vos marges

✅ Rétention : analyses détaillées du comportement de vos clients par cohortes, identification des facteurs clés de fidélisation

✅ Renouvellements : projection du MRR futur, anticipation des opportunités de croissance et réduction des risques de churn

✅ Forecast : génération de scénarios de croissance de vos revenus pour mieux anticiper vos décisions stratégiques

Fincome est la seule plateforme clé en main dédiée aux entreprises à modèle de revenus récurrents qui combine :

✅ une vision complète et fiable de vos revenus récurrents (MRR, ARR, churn, LTV, CAC, cohortes, renouvellements, reconnaissance du revenu et PCA),

✅ des rapports sur-mesure, automatisés et partageables, adaptés à chaque audience et reposant sur l’IA pour délivrer des insights actionnables, afin de guider vos décisions stratégiques,

✅ un accompagnement expert pour structurer vos analyses et vous accompagner dans leur interprétation, sans nécessiter d’internaliser une équipe data

✅ la possibilité de générer des scénarios de croissance futur, de les comparer les uns et aux autres et de comparer vos performances réalisées à vos prévisions, en temps réel, de manière automatisée.

Contrairement aux solutions de BI classiques qui nécessitent de construire les indicateurs et des maintenir dans le temps, en consommant des ressources à vos équipes pour se limiter à de la data visualisation, Fincome transforme vos indicateurs SaaS en recommandations concrètes, vous permettant de gagner en réactivité, en impact et en efficacité opérationnelle.

Vous utilisez un outil non répertorié par Fincome ou interne pour facturer vos clients ? Aucun problème, vous pouvez facilement importer vos données de facturation au format Excel ou les déverser via notre API publique.

Vous pouvez accéder à la documentation de notre API publique ici.

Fincome vous permet de :

✅ Réduire jusqu’à 90 % le temps consacré au calcul et au reporting de vos KPIs

✅ Décupler la rapidité et la précision de vos décisions stratégiques

✅ Récupérer jusqu’à 5 % de revenus perdus via la détection d’erreurs ou d’omissions

✅ Réduire de 80 % le risque d’erreurs par rapport à un suivi manuel sur tableur

La sécurité de vos données est au cœur de nos préoccupations. Fincome est certifié SOC 2 Type I, garantissant un haut niveau de sécurité et de protection de vos données.

Vos données sont collectées uniquement via des API “read-only” et hébergées sur des serveurs sécurisés basés en France. Elles ne sont jamais partagées avec des tiers sans votre consentement.

Pour évaluer dans le détail nos procédures de sécurité, nous vous invitons à consulter notre page dédiée sur le sujet.

Chez Fincome, l’accompagnement client est clé. Nous vous guidons dès l’onboarding pour structurer vos données, former vos équipes et optimiser votre utilisation de la plateforme pour en tirer toute la valeur rapidement.

Notre équipe reste à vos côtés pour répondre à vos questions stratégiques, techniques, partager des bonnes pratiques et vous aider à exploiter vos analyses au maximum.

Il vous suffit de demander une démo sur notre site. Nous vous présenterons la plateforme, identifierons ensemble vos enjeux et vous accompagnerons pour déployer Fincome rapidement et efficacement au sein de votre organisation. Le déploiement et la formation de vos équipes pour la prise en main de la solution n’excède généralement pas 2 semaines.

👉 Demandez une démo

Income Analytics:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Budget Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Wealth Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.