What is the Annual Run Rate?

For SaaS businesses, understanding key metrics is crucial for making informed decisions. The Annual Run Rate is an essential indicator of financial health, particularly valuable for startups and growing companies.

This guide simplifies the Annual Run Rate, explaining what it is, how to calculate it, and the best practices to follow. We'll answer key questions to give you a clear understanding of how to use the Annual Run Rate to benefit your business.

Crunching the Numbers: Your Guide to Understanding the Annual Run Rate

The Annual Run Rate is a financial metric that extrapolates a company's revenue over a short period, like a month or a quarter, to predict its annual revenue. This method of projection is particularly prevalent in SaaS business reporting where consistent revenue streams are key indicators of financial health.

The Annual Run Rate is often used by rapidly growing companies or those that don’t yet have a full year of financial data.

Imagine a startup that's been active for six months, making $50,000 each month. By applying the Annual Run Rate, we extend this monthly revenue across a full year to estimate the startup's yearly income. In this case, multiplying $50,000 by 12 months gives us an Annual Run Rate of $600,000. This calculation provides a clearer picture of what the startup's revenue might look like after its first complete year of operation.

However, it is important to note that The Annual Run Rate is a rough estimate that assumes the company's financial performance will continue at the same rate throughout the year (i.e. without growth nor churn).

The Annual Run Rate vs MRR

The Annual Run Rate and Monthly Recurring Revenue (MRR) are often used interchangeably but signify different aspects of a business's financial health.

MRR captures the total predictable revenue a company expects to receive every month, based on active subscriptions. It's calculated by multiplying the number of paying customers by the average amount paid per customer per month.

Monthly Recurring Revenue = # Customers x Average Revenue per Account (ARPA)

For services that are not billed monthly, the total subscription value is divided by the subscription period (in months) to determine the MRR. This tells you what amount of income is generated every month.

For example, if a service is billed annually at $1,200, the Adjusted MRR for this service would be:

Adjusted MRR= $120012 months=$100 per month

The Annual Run Rate, on the other hand, is an annualized version of MRR. The Annual Run Rate projects what the MRR suggests the revenue will be over a year.

How to Calculate the Annual Run Rate?

Computing The Annual Run Rate is a straightforward process; to calculate it, you just need to multiply the revenue from a specific period by the number of those periods in a year. For instance, to annualize your Monthly Recurring Revenue (MRR), you would multiply your MRR by 12.

Annual Run Rate = Monthly Recurring Revenue x 12

However, this straightforward approach can overlook factors such as monthly sales volatility and seasonal variations. An MRR that greatly differs from month to month will impact the accuracy of the Annual Run Rate (ARR) calculation.

To address this, many businesses opt to calculate their Annual Run Rate based on quarterly revenue. This method tends to provide a more balanced view, effectively smoothing out month-to-month fluctuations in revenue.

Annual Run Rate = Quarterly Revenue x 4

An Application of the Annual Run Rate

Let’s consider a SaaS company that operates on a subscription-based revenue model. This company earned $500,000 in the first quarter of the year. To calculate their annual run rate, the company would multiply their quarterly revenue by 4 (the number of quarters in a year), resulting in a $2 million annual run rate.

2,000,000 = 500,000 x 4

However, The Annual Run Rate is a simplistic projection. For SaaS companies, where monthly or annual subscriptions can significantly impact revenue, relying solely on run rate for long-term planning can be misleading. It's a useful metric for a quick snapshot, but it should be complemented with other financial analyses for accurate forecasting.

These calculations demonstrate how monthly variations can influence the accuracy of the Annual Run Rate. Thus, while it offers a quick estimate, you should also keep track of monthly and quarterly revenue changes. Tracking these trends will help you anticipate market shifts, and make more informed decisions.

📌Key Takeaway

The Annual Run Rate is a financial metric for estimating a company's potential annual revenue based on a short time frame. It's beneficial for new companies lacking a complete fiscal year of data, but it's important to recognize that ARR is an estimate and assumes constant financial performance throughout the year.

Why use the Annual Run Rate?

There are several benefits to the computation and use of an Annual Run Rate. It will allow you to:

Estimate your startup's financial performance

The Annual Run Rate is useful for new startups with little data. Consider a startup making $20,000 a month from a new product. Multiply that by 12 to get an Annual Run Rate of $240,000. This figure can show investors that the startup is financially promising.

Set sales goals

Strategize to meet annual targets. If your company is targeting a 25% increase in its Annual Run Rate from $400,000 to $500,000, you can reverse-engineer this goal to set monthly or quarterly sales targets.

Evaluate business changes

Compare the Annual Run Rate before and after the change. If you introduce a premium service tier that boosts monthly revenue from $50,000 to $70,000, comparing the Annual Run Rate before and after this change ($600,000 vs. $840,000) can quantitatively measure its impact.

Evaluate and gauge your financial health

Regularly calculating the Annual Run Rate helps your company monitor its financial trajectory and allows you to make strategic decisions to ensure long-term sustainability and growth.

When Not to Use The Annual Run Rate

Despite its usefulness, the Annual Run Rate has limitations and you should not use it for every situation.

Businesses with High Churn Rates

Let’s take a subscription-based app experiencing a 20% churn rate. Relying solely on the Annual Run Rate could provide an overly optimistic view of financial stability. Monthly revenue might decline significantly over the year if the high churn rate is not addressed.

Seasonal Businesses

A holiday decor company that’s making 70% of its sales in Q4 could find the Annual Run Rate misleading. An Annual Run Rate based on peak season sales would not accurately represent the full year's revenue.

Impact of One-time Sales or Launches

For a company that launches a new product resulting in a significant but temporary spike in sales, the Annual Run Rate calculated during this period might not reflect sustainable revenue levels.

For instance, a software company launching a new tool might see a $100,000 revenue spike in the launch month; multiplying this for the Annual Run Rate could skew expectations.

Ignoring Growth or Decline Trends

The Annual Run Rate doesn't account for growth trends or market conditions. A tech startup in a rapidly expanding market will find that its actual revenue far surpasses its Annual Run Rate projections, while a company in a declining market might not achieve its Annual Run Rate forecast.

For more detailed financial planning, it's often advised to complement the Annual Run Rate with other financial metrics.

{{discover}}

Mistakes You Need to Avoid

When leveraging the Annual Run Rate for forecasting, it's important to sidestep common pitfalls that can distort your financial outlook. Here are key mistakes to avoid for a more accurate projection:

- Overlooking Seasonal Trends: Businesses with seasonal sales peaks should be cautious. Calculating the Annual Run Rate during your high season could inflate expectations, while calculations during off-peak times might underplay your financial potential.

- Incorporating Outliers: Exceptional sales, such as a one-time large contract, should be excluded from the Annual Run Rate calculations. These anomalies can lead to misleadingly optimistic forecasts.

- Neglecting Growth Trajectories: For startups and fast-growing companies, revenue can increase rapidly. Relying on the Annual Run Rate from a brief period without accounting for potential growth can fail to capture the full scope of your business's momentum.

Complementary Financial Metrics

Several other metrics can contribute to a comprehensive picture of a company's financial health. Here are some other metrics that are key SaaS KPIs:

Churn Rate

This metric measures the percentage of customers who end their subscriptions within a certain period. High churn rates can signal issues with customer satisfaction or product-market fit, directly affecting revenue and undermining the stability suggested by the Annual Run Rate. Conversely, low churn rates indicate strong customer loyalty, enhancing the reliability of the Annual Run Rate projections. Managing churn rate is essential for maximizing customer Lifetime Value (LTV) and ensuring a steady revenue stream.

Lifetime Value (LTV)

LTV, or Lifetime Value, calculates how much money a customer is likely to spend with your company over the entire time they do business with you. It's a key metric for seeing how valuable customer acquisition and retention strategies are over the long term. LTV is also useful alongside ARR to show potential revenue beyond just one year.

LTV=Monthly Payment × Months of Relationship

For example, if a customer pays $100 monthly for 3 years, the LTV calculation would be:

LTV=$100 × 36=$3,600

This means you can expect to earn $3,600 from this customer over the three years they stay with your company.

Customer Acquisition Cost (CAC)

CAC measures how much it costs to gain one new customer, factoring in all marketing and sales expenses. It helps evaluate how effective your acquisition strategies are and ensures these costs are reasonable compared to your earnings. A good LTV to CAC ratio shows your business model is geared towards growth and making a profit, which is key to backing up the Annual Run Rate as an indicator of growth.

CAC = Total Acquisition Cost# New Customers

For example, If your company spends $5,000 on marketing and sales and acquires 100 new customers, the CAC would be:

CAC = $5,000100 = $50 per customer

Average Revenue Per Account (ARPA)

ARPA calculates the average revenue each customer account brings in, helping you understand revenue patterns and the worth of customers. It's useful for predicting income and planning strategies, and it gives a detailed view of revenue on a per-customer basis, complementing ARR's broader perspective.

ARPA = Total Revenue# Accounts

For example, if your business earns $10,000 from 200 customer accounts, the ARPA would be:

ARPA= $10.,000200 = $50 per customer

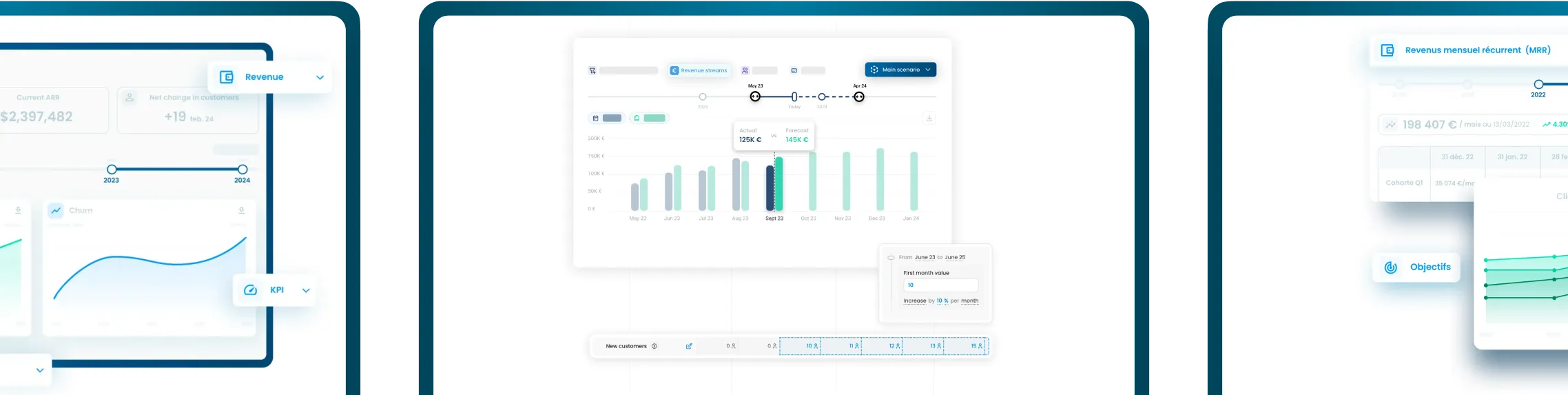

If your SaaS company is striving to make strategic decisions based on real-time data, Fincome is your go-to solution. With Fincome, you receive a comprehensive analysis of all your subscription analytics in one place, in real time.

From accurate forecasting to detailed segmentation of your SaaS analytics, Fincome empowers you to make informed decisions quickly and confidently.

Frequently Asked Questions About Annual Run Rate

What is the Difference Between the Annual Run Rate and the Annual Recurring Revenue?

For a SaaS or subscription-based company, it is good to measure both the Annual Run Rate and the Annual Recurring Revenue.

The key distinction between these two financial metrics lies in their applicability: while the Annual Run Rate is versatile and can be applied to various revenue models across different industries, the Annual Recurring Revenue is specifically tailored for companies with subscription-based revenue models.

How is Monthly Recurring Revenue Different from the Annual Run Rate?

While both MRR and the Annual Run Rate measure recurring revenue, MRR calculates monthly revenue whereas the Annual Run Rate projects annual revenue.

Is it Reliable to Calculate the Annual Run Rate Based on One Month's Revenue?

Calculating Annual Run Rate from a single month's revenue can be misleading due to the volatility of month-to-month sales. This is especially true for seasonal businesses or in cases where a significant contract skews the revenue for a particular month.

How Can Businesses Address Monthly Variations in the Annual Run Rate?

To mitigate monthly fluctuations in revenue, some businesses calculate the Annual Run Rate based on quarterly revenue instead of monthly revenue. This approach makes the Annual Run Rate estimate more resilient to one-off variations.

What's the Difference Between Run Rate and Burn Rate?

The run rate estimates a company's future revenue based on current performance. In contrast, the burn rate measures the rate at which a startup spends its capital before reaching profitability.

What Other Key Revenue Metrics Should Businesses Track?

Besides the Annual Run Rate, businesses should monitor metrics like MRR, Total Contract Value (TCV), Burn Rate, Annual Contract Value (ACV), Average Revenue Per User (ARPU), Customer Acquisition Cost (CAC), and Churn Rate. These metrics offer a comprehensive view of a company’s financial performance and health.

Is it Worth for your Business?

The Annual Run Rate is a useful tool for businesses, especially startups and those in rapid growth phases, to gauge their financial trajectory. However, its reliance on the assumption of consistent financial performance can be a double-edged sword.

It is important that you use Annual Run Rate as a preliminary guide rather than a definitive forecast, and that you supplement it with other metrics like churn rate, customer acquisition cost (CAC), and average revenue per user (ARPU) for more nuanced financial analysis.

Fincome is here to transform how you view and utilize your financial data. You can generate forecasts, create what-if scenarios, and gain insights that drive smart decisions for your SaaS business.

Step into the future of financial analytics and try Fincome today!

{{newsletter}}

Discover Fincome!

Frequently Asked Questions

Expense Tracking:

Fincome is a SaaS revenue management platform designed specifically for companies with recurring revenue models (any business selling subscriptions).

Fincome automates the tracking and management of your revenues and associated KPIs (churn, LTV, CAC, etc.) in real time, without the need for a data team or manual processing, thanks to direct integrations with your billing systems and ERP.

Unlike generic BI tools, Fincome offers a turnkey, intuitive solution tailored to the specific needs of subscription-based businesses, enabling seamless collaboration across your finance, GTM, and CSM teams.

Fincome is built exclusively for companies with recurring revenue models, meaning those that track MRR or ARR, such as:

• Software publishers (SaaS)

• Media companies

• Mobile apps

• Any other B2B or B2C subscription business looking to professionalize revenue management

Fincome supports organizations at every stage of growth, from startups to mid-market and large international enterprises.

With Fincome, you gain access to a full suite of modules:

✅ Revenue: detailed ARR/MRR breakdown, cohort analysis, detection of billing errors or omissions, revenue recognition and deferred revenue (PCA)

✅ Growth: analysis of ARR movements (new business, expansion, churn, reactivation), identification of growth drivers

✅ Unit Economics: LTV, CAC, and LTV/CAC analysis by segment, channel, or geography to optimize margins

✅ Retention: deep cohort analyses, identification of key retention drivers

✅ Renewals: future MRR projections, opportunity forecasting, and churn risk reduction

✅ Forecasting: revenue growth scenario modeling to better inform strategic decisions

Fincome is the only turnkey platform built specifically for recurring revenue businesses that combines:

✅ A complete, reliable view of your recurring revenues (MRR, ARR, churn, LTV, CAC, cohorts, renewals, revenue recognition, deferred revenue)

✅ Fully customizable, automated, shareable reports powered by AI, delivering actionable insights to guide your strategic decisions

✅ Expert support to help structure and interpret your analyses, without needing to build an internal data team

✅ The ability to generate future growth scenarios, compare them side by side, and track actual vs. forecasted performance, all in real time

Unlike traditional BI tools, which require you to build and maintain your own metrics (often consuming internal resources just to produce static data visualizations), Fincome transforms your SaaS metrics into concrete, actionable recommendations — helping you move faster, with more impact and operational efficiency.

Yes! If you use an unlisted or in-house billing system, no problem — you can easily import your billing data via Excel or push it through our public API. You can access our public API documentation here.

With Fincome, you can:

✅ Reduce up to 90% of the time spent calculating and reporting your KPIs

✅ Make faster, more accurate strategic decisions

✅ Recover up to 5% of lost revenue by detecting errors or omissions

✅ Cut the risk of manual spreadsheet errors by 80%

Absolutely. Data security is at the heart of what we do. Fincome is SOC 2 Type I certified, ensuring a high level of data security and protection.

Your data is collected exclusively via read-only APIs and hosted on secure servers located in France. We never share your data with third parties without your consent.

For a detailed review of our security practices, please visit our dedicated security page.

At Fincome, customer success is a core priority. We guide you from the very start — structuring your data, training your teams, and optimizing your use of the platform to deliver value quickly.

Our team remains by your side to answer strategic or technical questions, share best practices, and help you get the most out of your analyses.

Simply request a demo on our website. We’ll walk you through the platform, assess your needs, and guide you through a smooth deployment.

Most deployments and team trainings take no more than two weeks to get fully up and running.

👉 Request a demo

Income Analytics:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Budget Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Wealth Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.