Top tips for communicating with SaaS investors

Raising capital from investors is often a necessary step for startups to finance product development and accelerate customer acquisition. In most cases, an investor will ask for regular updates on your company’s progress. If not properly framed, this reporting can quickly become a source of stress for entrepreneurs and of frustration for shareholders.

So how do you best manage communication with your investors?

Communication must be adapted to the type of person and level of information they require. However, there are best practices—both in terms of content and form—that can help you establish clear, stress-free communication and win investors’ trust.

This article provides the essential keys to achieving this.

1 - How to communicate with investors

When investors invest in a fledgling company, their aim is to generate a capital gain by selling their shares over time. As a result, the development and progress of a startup is something they will follow closely for the duration of their investment.

They therefore generally require periodic updates on the company’s performance, administration, and results.

Besides the figures, they also need to be able to establish a relationship of trust with the founders and managers.

This requires fluid, transparent financial communication.

1.1 - Adapting your communications to your investors

Company managers need to adapt their communications to the different types of investors and their varying needs. Understanding investors’ information needs is the key to providing them with relevant reporting and establishing a relationship of trust.

1.2 - What are the types of investors and their expectations?

Not all shareholders who invest in a startup have the same characteristics. Investors fall into a few broad categories.

These are the types of investors who invest in startups:

- Business angels are individuals. They often have entrepreneurial experience and want to support promising projects. Their reporting needs are generally limited.

- Investment funds (VCs) are specialists in large-scale fundraising. Whether private or institutional, specialized in the sector, or French or foreign, these capital investment professionals exit companies on average within 5 to 10 years. Investment funds require comprehensive monthly reporting of sales performance, analysis of costs, profitability, and cash flow).

- Corporate funds are set up by large groups wishing to invest in startups over the long term. They generally require the same type of reporting as VCs.

- Equity crowdfunding is often from individuals via specialized platforms. Their reporting requirements are generally limited.

2 - Reporting is key for communicating with investors

Founders and managers therefore need to adapt their communications to the profile of their investors. In all cases, producing relevant and reliable information is essential to maintaining a good relationship with investors. It’s the basis of trust.

2.1 - Communicating the right indicators to investors

How do you choose the content of a periodic financial report to investors? Here are a few recommendations for structuring your reports.

a - What is a good KPI for an investor?

A good KPI (key performance indicator) is an item of information or a financial ratio. It must be:

- relevant and useful for the startup and its specific business sector;

- reliable and consistent in its method of calculation;

- easily auditable and traceable to its data source.

b - How to choose the right financial indicators?

The selected KPIs must enable at-a-glance assessment and monitoring of development, financial performance, and cash management. Each business sector has its own typical KPIs for investors. You need to have this initial set of KPIs, possibly supplemented by indicators from the CFO.

2.2 - The right tools for simple reporting

Effective financial communication with investors also requires a careful choice of appropriate, high-performance management and reporting tools. Startup managers may find it difficult to define their KPIs, prepare updates, and produce monthly reports on their own.

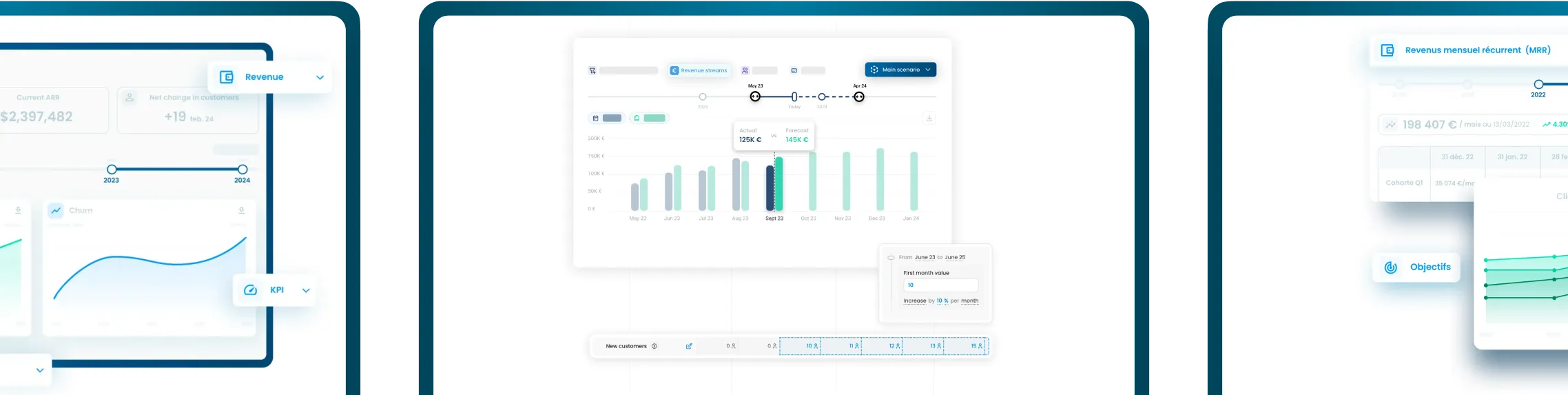

That’s why Fincome offers these entrepreneurs the opportunity to produce their reporting at the click of a button, by concentrating all company data automatically on its platform. With this SaaS solution, managers can focus on their startup and the analysis of KPIs, rather than on generating them.

{{discover}}

3 - It’s not just what, but how you communicate with investors

The substance of the communication is important, but so is the form, if we are to build a relationship of trust with investors.Investors often invest in a large number of companies, and their time is usually limited. We therefore recommend careful attention to the form and frequency of both management reporting and financial statements.

3.1 - Choosing the right frequency for communicating with shareholders

Communication with investors takes place in two ways:

- The annual general meeting, where management presents the annual financial statements to shareholders.

- Reporting, which provides a regular overview of business progress, often at board meetings.

💡 For management reporting, we recommend monthly reports.This keeps investors regularly informed of business developments without overwhelming them with reports and KPIs.

3.2 - Provide appropriate visual aids for your presentation

No matter how you communicate with investors (monthly or on set dates, whether by email, videoconference, telephone, or face-to-face meeting), how you keep investors up to date matters.

The form of your reporting plays a key role in creating a good relationship with your investors. By presenting financial data in relevant, understandable graphs or KPIs and by dividing the information into categories, you make investors’ work easier.It’s also proof of methodical, well-organized management.

💡 Fincome offers financial reporting with a 360° view of your performance. Our automated reporting solution directly links to your management tools to you save hours of grappling with spreadsheets. Essential financial information is presented in graph form, and arranged by category (revenue, growth and churn, KPI,cash, etc.).

3.3 - Analyzing and commenting on documents: the role of storytelling

Investor relations also involve knowing how to explain and analyze your reporting. You need to tell the story of your company through its figures.

Because producing figures is all and good. But illustrating them through storytelling is even better.

SaaS founders have their finger on the pulse of their startup. They have all the information they need to flesh out their pitches to investors. Communication is an art. But with the right tools, such as relevant financial reporting, one box has already been ticked.

In conclusion, any entrepreneur who raises funds is keen to maintain good relations with their investors. One of the key factors in communicating with shareholders is the quality of management reporting. Contact us for an online demo of how we make communicating with investors a cinch.

💡 Complete your reading with the following articles:

- 3 common mistakes that kill SaaS startups

- Automated reporting for SaaS: a quick guide

- KPI reporting at every stage of your startup

- Why is SaaS financial reporting still crucial for your startup in 2023?

{{newsletter}}

Discover Fincome!

Frequently Asked Questions

Expense Tracking:

Fincome is a SaaS revenue management platform designed specifically for companies with recurring revenue models (any business selling subscriptions).

Fincome automates the tracking and management of your revenues and associated KPIs (churn, LTV, CAC, etc.) in real time, without the need for a data team or manual processing, thanks to direct integrations with your billing systems and ERP.

Unlike generic BI tools, Fincome offers a turnkey, intuitive solution tailored to the specific needs of subscription-based businesses, enabling seamless collaboration across your finance, GTM, and CSM teams.

Fincome is built exclusively for companies with recurring revenue models, meaning those that track MRR or ARR, such as:

• Software publishers (SaaS)

• Media companies

• Mobile apps

• Any other B2B or B2C subscription business looking to professionalize revenue management

Fincome supports organizations at every stage of growth, from startups to mid-market and large international enterprises.

With Fincome, you gain access to a full suite of modules:

✅ Revenue: detailed ARR/MRR breakdown, cohort analysis, detection of billing errors or omissions, revenue recognition and deferred revenue (PCA)

✅ Growth: analysis of ARR movements (new business, expansion, churn, reactivation), identification of growth drivers

✅ Unit Economics: LTV, CAC, and LTV/CAC analysis by segment, channel, or geography to optimize margins

✅ Retention: deep cohort analyses, identification of key retention drivers

✅ Renewals: future MRR projections, opportunity forecasting, and churn risk reduction

✅ Forecasting: revenue growth scenario modeling to better inform strategic decisions

Fincome is the only turnkey platform built specifically for recurring revenue businesses that combines:

✅ A complete, reliable view of your recurring revenues (MRR, ARR, churn, LTV, CAC, cohorts, renewals, revenue recognition, deferred revenue)

✅ Fully customizable, automated, shareable reports powered by AI, delivering actionable insights to guide your strategic decisions

✅ Expert support to help structure and interpret your analyses, without needing to build an internal data team

✅ The ability to generate future growth scenarios, compare them side by side, and track actual vs. forecasted performance, all in real time

Unlike traditional BI tools, which require you to build and maintain your own metrics (often consuming internal resources just to produce static data visualizations), Fincome transforms your SaaS metrics into concrete, actionable recommendations — helping you move faster, with more impact and operational efficiency.

Yes! If you use an unlisted or in-house billing system, no problem — you can easily import your billing data via Excel or push it through our public API. You can access our public API documentation here.

With Fincome, you can:

✅ Reduce up to 90% of the time spent calculating and reporting your KPIs

✅ Make faster, more accurate strategic decisions

✅ Recover up to 5% of lost revenue by detecting errors or omissions

✅ Cut the risk of manual spreadsheet errors by 80%

Absolutely. Data security is at the heart of what we do. Fincome is SOC 2 Type I certified, ensuring a high level of data security and protection.

Your data is collected exclusively via read-only APIs and hosted on secure servers located in France. We never share your data with third parties without your consent.

For a detailed review of our security practices, please visit our dedicated security page.

At Fincome, customer success is a core priority. We guide you from the very start — structuring your data, training your teams, and optimizing your use of the platform to deliver value quickly.

Our team remains by your side to answer strategic or technical questions, share best practices, and help you get the most out of your analyses.

Simply request a demo on our website. We’ll walk you through the platform, assess your needs, and guide you through a smooth deployment.

Most deployments and team trainings take no more than two weeks to get fully up and running.

👉 Request a demo

Income Analytics:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Budget Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Wealth Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.