How to do revenue forecasting

.svg)

For SaaS start-up CEOs, mastering revenue forecasting is not just a goal, it's a necessity for sustainable growth. Predicting future income over a defined period involves blending historical data with future assumptions and professional judgment.

But why is revenue forecasting so vital?

Well, predicting your income and sales has a profound impact on decision-making. Accurate projections inform crucial strategies, from pricing to cash flow management, as well as attract investments, ultimately steering the trajectory of your business’s success.

However, effectively projecting your income can prove challenging, notably because of possible inaccuracies, like misalignment between projected sales trajectories and actual customer buying journeys, and inherent risks associated with being a new market entrant. Moreover, it can be difficult to predict when your start-up's growth will accelerate and identify inflexion points.

In this article we delve into the intricacies of revenue forecasting, drawing insights from successful startups to give you the best practices to project your income and sales.

Forecasting methods

Predicting revenue requires various methods such as top-down and bottom-up approaches, or strategic shifts from dissecting parts to understanding the engine of revenue generation. Overall, these are the best advice and techniques to project income, helping you assess your company's needs and goals.

Top-down and bottom-up methods

Top-down and bottom-up methods offer distinct yet complementary approaches to revenue forecasting.

The top-down approach involves analyzing macroeconomic factors, industry trends, and market conditions. This macro-level perspective will enable you to understand broader market dynamics and anticipate potential shifts that could impact your revenue generation. As recommended by Financial Modeling & Valuation Analyst, Dobromir Dikovy, assessing specific factors can help you develop a strategic framework for revenue forecasting which aligns with broader economic trends. Here are the ones to keep in mind:

- GDP growth

- % of market share captured

- Estimated market size

- Estimated active clients

- Average revenue per client

However, for Ivan Hoo, "the issue with [top-down] approaches lies in their lack of detail. For instance, a founder might claim to capture 3%, 5%, and then 10% of the market share, but the question remains - how? What resources does it take to get there? What are the key targets he needs to achieve that market share?”

That is why many founders or specialists recommend using a mix of top-down and bottom-up methods. For instance, according to Hrvoje Smolic, founder of Graphite Note, using various forecasting techniques provides a more comprehensive view of your future income. Combining top-down and bottom-up approaches can enhance the precision of revenue projections for your company. Similarly, to fill the need for comprehensive market analysis and realistic growth expectations, Andy Hamer, CEO and founder of Gorilla Team Associates, says: "in forecasting technology sales, I employ both top-down and bottom-up approaches."

The bottom-up approach delves into granular details, evaluating individual customer metrics, product performance, and sales pipelines to forecast revenue at a micro-level. As advised by Dobromir, this method involves aggregating data from various sources to generate more accurate revenue projections. You can focus on the following metrics:

- Customer Acquisition Costs (CAC)

- New clients quota

- Average quota realization

- Churn rates

- Conversion rates

By analyzing drivers of revenue growth at the customer level, you can identify opportunities for optimisation and prioritize resources effectively.

Daren Lauda, CEO at Outset, advocates for a process-centric, bottom-up revenue plan combined with top-down growth objectives, emphasizing the importance of cross-functional collaboration.

By integrating different methodologies, you can achieve a better understanding of revenue potential. Combining both top-down and bottom-up approaches will allow you to balance strategic foresight with operational precision and make informed decisions for sustainable growth.

Holistic revenue forecasting: shift from parts to engine

Adding up to the global vision you can get by combining top-down and bottom-up methods, holistic revenue forecasting means taking into consideration all processes driving revenue growth in your predictions.

By shifting from parts to engine, you will go from analyzing individual components or aspects of revenue generation to understanding and optimizing the overall system and considering the interconnectedness of various revenue drivers within your company. As Daren Lauda puts it, CEOs should aim to build a cohesive, cross-functional revenue engine rather than managing the revenue engine as separate parts, such as sales, marketing, customer success, etc.

In practice, to have such a holistic approach, you should shift your focus from and move beyond isolated metrics such as customer acquisition costs (CAC), churn rates, or individual sales pipelines, to analyze larger metrics instead. According to Bilal Surahyo, CFO and CIO at Simpli Home Furniture, “calculating non-recurring revenue in SaaS revenue forecasting is pivotal. Non-recurring revenue, stemming from various sources beyond subscription fees, is a key component. This holistic approach enables SaaS companies to make informed decisions and adapt their strategies in an ever-evolving market.”

Non-recurring revenue encompasses various revenue streams, including one-time fees such as setup or implementation charges, variable fees like usage or transaction fees, and supplementary services such as consulting, support, or maintenance fees. Estimating it for each month and year of your forecast requires careful consideration of your pricing model, customer behavior assumptions, and the range of services you offer.

{{discover}}

Strategies for accuracy in sales forecasting

Understanding the market

Understanding the market is fundamental to crafting accurate sales forecasts. It involves a comprehensive analysis of market dynamics, competitor behavior, and industry trends. Make sure you take economic indicators, regulatory changes, and technological advancements into account before projecting your future income. By informing yourself about these topics, you can identify emerging opportunities or potential threats that may impact your sales forecasts, as market fluctuations can be responsible for revenue forecast inaccuracies.

Moreover, a key aspect of this involves understanding the customer journey. As noted by industry experts: “Real insights emerge only after a history of completed deals. Until then, the sales cycle remains largely theoretical.” Therefore, gaining practical experience and data from your completed sales transactions can help you better understand users’ behavior and preferences throughout the sales cycle, further enabling you to make informed projections.

Indeed, this deeper understanding will allow you to anticipate customer needs, preferences, and potential roadblocks, and thus develop more accurate and actionable strategies to drive revenue growth.

Looking at innovative businesses

Andy Hamer, CEO and founder of Gorilla Team Associates, suggests that: "The best strategy for sales forecasting in startups involves a comprehensive understanding of the market, targeting the right businesses, and leveraging successful deals to build a compelling narrative.” Therefore, looking at innovative businesses and fast-growing start-ups is a good way to understand market trends and new industry developments to craft compelling narratives for your sales forecasting.

Indeed, innovative businesses often embrace risk and explore new solutions, making them fertile ground for your sales forecasting strategies. Forward-thinking start-ups are often early adopters of new technologies or approaches, so they represent valuable examples to base your analysis on and enhance the accuracy of your sales forecasts.

Monitoring KPIs

Essential metrics to look at

While doing a bottom-up study for your revenue forecasting, you will need to analyze your financial data. And apart from non-recurring revenue, other essential financial metrics play a crucial role in assessing your business's health and direction to predict future trends.

The first one you need to pay attention to is Monthly Recurring Revenue (MRR). Stemming from existing customers, MRR represents a dependable revenue stream. Its accurate calculation is primordial for evaluating your company’s financial stability and refining your growth strategies. As emphasized by Bilal Surahyo, CFO at Simpli Home Furniture, MRR serves as a cornerstone metric for understanding revenue dynamics and optimizing growth trajectories.

In addition to MRR and ARR, several key assumptions should drive your revenue forecast model, facilitating quick and comprehensive revenue and customer projections. According to Ben Murray, former SaaS CFO and founder of The SaaS CFO, these inputs include:

- Number of customers and Customer Lifetime Value (CLTV): Understanding your customer base and their lifetime value aids in projecting future revenue streams and optimizing customer acquisition strategies.

- Customer Acquisition Rate and Customer Acquisition Cost (CAC): Assessing the efficiency and cost-effectiveness of customer acquisition efforts is essential for sustainable growth and profitability.

- Churn rate: Monitoring your churn rate provides insights into customer retention and will help in mitigating revenue loss due to customer attrition.

- Average Selling Price (in MRR or ARR): Analyzing the average revenue generated per customer enables you to implement better pricing strategies and conduct accurate revenue forecasting.

- Customer Dollar Expansion: Identifying opportunities for upselling or cross-selling to existing customers contributes to revenue growth and enhances predictions.

By looking at these KPIs, you can gain a comprehensive understanding of your revenue dynamics, drive informed decision-making, and position yourself for sustained success.

Visualization and clarity

Daniel Lunani, Customer Support at FinTech, mentions that “data visualization tools, such as Tableau, Power BI, and D3.js, transform complex datasets into visually accessible insights.” These tools play a crucial role in simplifying complex financial and operational information, presenting it clearly and compellingly. By leveraging charts, graphs, and tables, you can highlight critical metrics and trends, making them more accessible and insightful for stakeholders, including your board members.

In line with this advice, Ben Murray, founder of The SaaS CFO, suggests avoiding overcrowding cells with complex formulas when visualizing revenue movement insights, such as MRR inflow and outflow. Murray advises laying out rows and formulas in a manner that facilitates quick comprehension of how each number is calculated.

By adopting this approach to sort and analyze your financial metrics, you can streamline financial reporting processes and ensure accuracy and precision in revenue forecasting.

Effective execution and management

Consistency and standardization

Making sure your forecasting processes are standardized, and follow a consistent and rigorous method will enable you to be more efficient and precise in your income predictions.

Jonathan Fianu, Director and Global Revenue Operations at ComplyAdvantage is advising to pay attention to three elements:

- The enablement side: make sure elements are set up, and that there is training and governance around what you are deploying.

- The process side: working with the management and the individual sales leaders to embed that process and have it consistent.

- Constant reviewing: you might not get it right the first try, so you will need to make tweaks and changes.

Moreover, implementing methods for daily management of go-to-market execution is crucial for ensuring consistent performance and addressing any gaps or misses promptly. As highlighted by Daren Lauda, proactive problem-solving is essential in this regard, enabling your teams to anticipate challenges and take preemptive actions to mitigate risks.

Therefore, not only do you need the right methods, but you should also make sure their implementation is precise and constant.

Scientific approach to revenue generation

Aditya and Yaag, in The Modern SaaS Podcast, present a scientific method for revenue forecasting which involves methodically testing hypotheses and refining your strategies based on empirical evidence. This approach requires that you treat revenue generation as an ongoing experiment, where each action is carefully planned, executed, and evaluated based on its impact on the desired outcomes.

Aditya and Yaag stress the significance of focusing on predictable revenue, with repeatable habits and processes. To build predictable revenue, you can follow the following approach:

- First, you should define a clear revenue goal and work backwards to develop strategies and processes to achieve it (backcasting).

- Then, develop predictable marketing and sales processes contributing to revenue growth. This involves optimizing lead generation, nurturing, and conversion tactics to maximize returns on investment.

- Establish predictable prospecting routines, both inbound and outbound.

- Further, train go-to-market teams to develop predictable habits and routines for consistent performance.

- Finally, emphasize the importance of predictable calendars and routines to achieving predictable revenue.

By following this scientific approach, you can systematically drive revenue growth while minimizing uncertainties and risks.

Conclusion

In conclusion, mastering revenue forecasting is crucial for your start-up’s sustainable growth. Accurate projections will inform your pricing strategies and cash flow management, and attract investments, to lead you to success.

From top-down and bottom-up approaches to embracing a holistic view of revenue generation, we reviewed the best practices from start-up CEOs and founders to help you master the art of income forecasting. Monitoring KPIs, understanding the market and customer journey, and adopting consistent processes will contribute to clarity and precision and help you improve your business’s predictions.

Effective revenue forecasting requires strategic vision and operational excellence. By implementing these insights, you can navigate complexities with confidence, and ensure long-term success.

{{newsletter}}

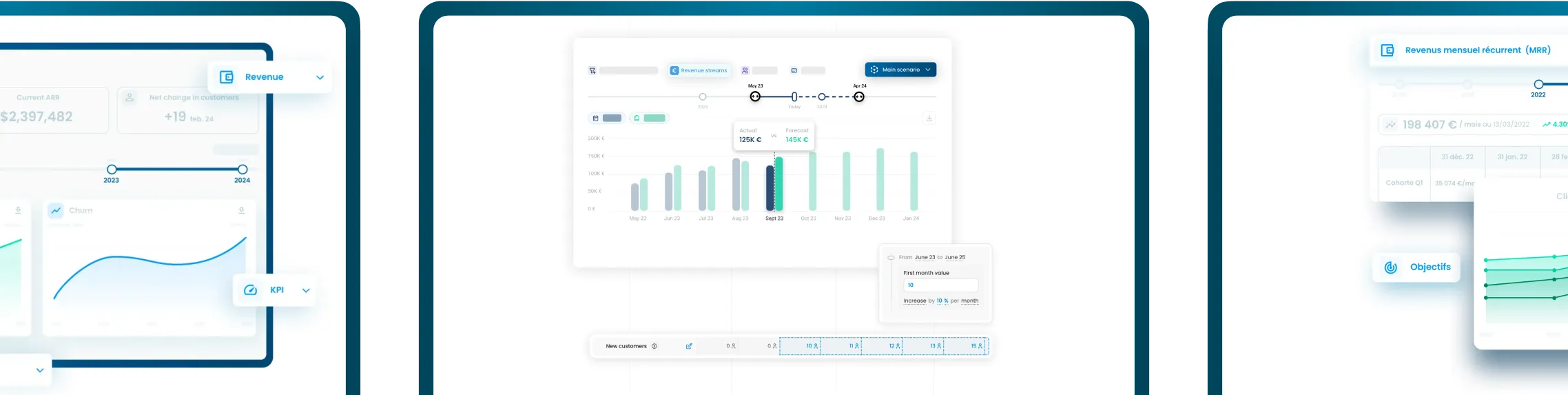

Discover Fincome!

Frequently Asked Questions

Expense Tracking:

Fincome is a SaaS revenue management platform designed specifically for companies with recurring revenue models (any business selling subscriptions).

Fincome automates the tracking and management of your revenues and associated KPIs (churn, LTV, CAC, etc.) in real time, without the need for a data team or manual processing, thanks to direct integrations with your billing systems and ERP.

Unlike generic BI tools, Fincome offers a turnkey, intuitive solution tailored to the specific needs of subscription-based businesses, enabling seamless collaboration across your finance, GTM, and CSM teams.

Fincome is built exclusively for companies with recurring revenue models, meaning those that track MRR or ARR, such as:

• Software publishers (SaaS)

• Media companies

• Mobile apps

• Any other B2B or B2C subscription business looking to professionalize revenue management

Fincome supports organizations at every stage of growth, from startups to mid-market and large international enterprises.

With Fincome, you gain access to a full suite of modules:

✅ Revenue: detailed ARR/MRR breakdown, cohort analysis, detection of billing errors or omissions, revenue recognition and deferred revenue (PCA)

✅ Growth: analysis of ARR movements (new business, expansion, churn, reactivation), identification of growth drivers

✅ Unit Economics: LTV, CAC, and LTV/CAC analysis by segment, channel, or geography to optimize margins

✅ Retention: deep cohort analyses, identification of key retention drivers

✅ Renewals: future MRR projections, opportunity forecasting, and churn risk reduction

✅ Forecasting: revenue growth scenario modeling to better inform strategic decisions

Fincome is the only turnkey platform built specifically for recurring revenue businesses that combines:

✅ A complete, reliable view of your recurring revenues (MRR, ARR, churn, LTV, CAC, cohorts, renewals, revenue recognition, deferred revenue)

✅ Fully customizable, automated, shareable reports powered by AI, delivering actionable insights to guide your strategic decisions

✅ Expert support to help structure and interpret your analyses, without needing to build an internal data team

✅ The ability to generate future growth scenarios, compare them side by side, and track actual vs. forecasted performance, all in real time

Unlike traditional BI tools, which require you to build and maintain your own metrics (often consuming internal resources just to produce static data visualizations), Fincome transforms your SaaS metrics into concrete, actionable recommendations — helping you move faster, with more impact and operational efficiency.

Yes! If you use an unlisted or in-house billing system, no problem — you can easily import your billing data via Excel or push it through our public API. You can access our public API documentation here.

With Fincome, you can:

✅ Reduce up to 90% of the time spent calculating and reporting your KPIs

✅ Make faster, more accurate strategic decisions

✅ Recover up to 5% of lost revenue by detecting errors or omissions

✅ Cut the risk of manual spreadsheet errors by 80%

Absolutely. Data security is at the heart of what we do. Fincome is SOC 2 Type I certified, ensuring a high level of data security and protection.

Your data is collected exclusively via read-only APIs and hosted on secure servers located in France. We never share your data with third parties without your consent.

For a detailed review of our security practices, please visit our dedicated security page.

At Fincome, customer success is a core priority. We guide you from the very start — structuring your data, training your teams, and optimizing your use of the platform to deliver value quickly.

Our team remains by your side to answer strategic or technical questions, share best practices, and help you get the most out of your analyses.

Simply request a demo on our website. We’ll walk you through the platform, assess your needs, and guide you through a smooth deployment.

Most deployments and team trainings take no more than two weeks to get fully up and running.

👉 Request a demo

Income Analytics:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Budget Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Wealth Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.