What do VCs expect in your monthly report (KPIs/metrics)?

Drafting and writing monthly reports for your SaaS start-up can be challenging, especially when the expectations evolve as your company grows. Understanding venture capitalists’ (VCs) perspective is the first step towards improved communication with your investors. As a founder, you want your partners to understand your business’s financial health and operations efficiently. This is where the importance of clear concise monthly reporting lies.

Your monthly reports are the window through which VCs will gauge your start-up’s performance and potential. Mastering the art of compiling these can make or break investor confidence and funding opportunities. But what exactly do VCs want to know? It's not just about displaying data – it's about presenting the right metrics and Key Performance Indicators (KPIs) to reflect your business's current state and trajectory.

This article delves into the practicalities, offering actionable insights, use cases and concrete examples to elevate your reporting proficiency as a founder. From the importance of transparency and accountability to the evolving landscape of start-up metrics, we will navigate through the different expectations at various stages of your company’s growth.

The crucial role of monthly reports for VC predictions

The success of your start-up depends, first and foremost, on a good relationship of trust with investors. That's why investing in effective and transparent communication with them is essential.

It's all down to your monthly reports. Presenting your results organised and transparently and highlighting critical data and metrics will ensure your investors have all the updates they need to evaluate your business’s performance and potential for growth and profitability.

As Alice Besomi, VP of Investments at Jungle Ventures, puts it: “We will look at [your data] from an operational perspective, trying to understand if you can profitably scale the business.”

Moreover, monthly reports foster trust between founders and investors, as they demonstrate your commitment to managing funds responsibly and ensuring good governance. To maximise the impact of your reports, focus on clarity, relevance, and transparency.

Indeed, Paul Roche, senior partner at McKinsey & Company, explains: “Top performers insist on transparent data and metrics that allow them to gain an integrated view of growth and margin drivers. This visibility helps them to execute against bold growth, efficiency, and productivity targets and to make decisions on new investments at a global integrated level.”

By adhering to these best practices, your SaaS start-up will strengthen its relationship with investors, multiplying its chances of success in a competitive landscape.

What metrics are traditionally expected at each stage of your business’s funding?

At every stage of your company’s growth, VCs will focus on different metrics and examine specific results from your reports. Thus, as an entrepreneur, you are expected to adapt your accounts after each fundraising occurrence. Not only do you want to meet the goals VCs are looking for, but also highlight them clearly to update investors on your progress.

Looking at the details of your funding journey will help you elaborate better reports by collecting the correct data to promote your company.

Seed Funding

As a young business, you probably don’t have many results to show to impress investors. This is why, at this stage, you should primarily focus on demonstrating that your products or services have a place in a competitive market. Essentially, VCs must see potential in your company and be sure their risks are secured under a strong business plan.

This means the metrics you should emphasise reflect targeting audience interaction, such as user engagement, product usage, social proof and revenue growth.

- User engagement and product usage measure how valuable users find your product based on how much and how long they interact with it.

- Social proof reflects the positive feedback from your customers.

- Revenue growth shows investors how quickly you were able to expand your sales, and it can be measured with metrics such as monthly recurring revenue (MRR) and annual recurring revenue (ARR).

- Additionally, customer acquisition cost (CAC), customer lifetime value (LTV), burn rate, and churn rate are crucial for demonstrating business viability and efficiency.

Although these metrics can be interesting at this early stage, they could be more decisive. VCs will see your start-up as a market opportunity to develop, more than an ongoing successful business to support.

Series A Funding

As you hit the Series A funding stage, VCs recognise your business has the potential to grow, but it is time for you to meet their expectations. Here, investors are looking for concrete proof of viability and scalability.

Alice Besomi explains that “product-market fit is the first thing VC investors will be looking at to understand how valuable the product, service or platform is for the customers.”

She then questions:

- How many new customers are you adding on a month-to-month basis?

- How much new revenue are you bringing?

- How well-defined are the go-to-market and sales motions?

Therefore, you must use metrics like revenue growth, unit economics, market penetration, and operational scalability to give VCs answers.

Here, revenue growth will again prove you can attract customers who will buy your offer. An increasing MRR and solid quarter-over-quarter growth can show this.

- Unit economics refers to your business's direct revenues and costs on a per-unit basis.

- Market penetration measures the proportion of a product or service sold compared to the estimated total market.

- Operational scalability indicates your business's capacity to adjust and develop its operations smoothly as it expands.

Additionally, a low churn rate and CAC, as well as a high LTV will prove to investors your business has a solid product-market fit.

These metrics are essential at this stage to show evidence of your business’s value, traction and potential for growth and development.

Series B Funding

As a Series B funding company, your business is well-established, and your valuations must reflect that.

For instance, at this stage, you should pay attention to the Rule of 40, which dictates that the combined growth rate and free cash flow rate should equal 40% or higher.

As McKinsey partner Paul Roche emphasises, VCs often use this as a critical indicator of your start-up’s success.

While achieving it might be challenging, focusing on essential metrics such as revenue growth, profit margin, market share, brand recognition, burn rate, and CAC can help your company align its strategies with the Rule of 40 frameworks. Additionally, you should carefully monitor and optimise ARR growth, net retention rate, payback period, and free cash flow percentage, as these factors can influence the Rule of 40 success. These metrics will show investors clear plans and momentum and a good balance between growth and profitability, suggesting your Series B start-up is ready to dominate its market.

Summary - Essential Metrics for your journey

Top VCs Aman Verjee and Dave McClure - who invested in companies like Canva, Lyft, Reddit, and more - give this overall summary of the most important metrics you should consider at every stage of your business’s funding journey (excluding seed stage):

Frequently Asked Questions

Expense Tracking:

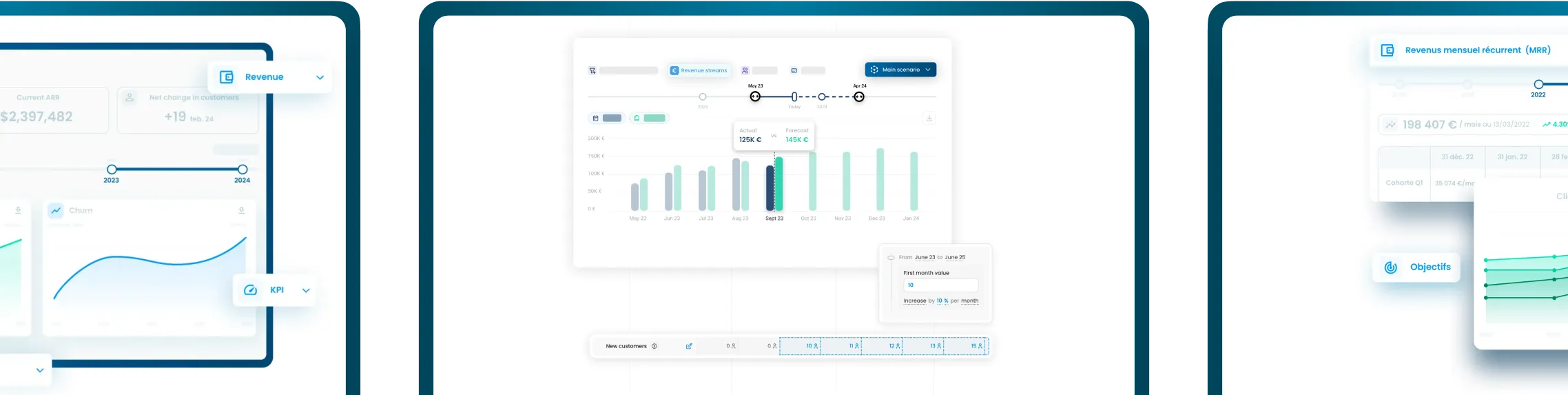

Fincome is a SaaS revenue management platform designed specifically for companies with recurring revenue models (any business selling subscriptions).

Fincome automates the tracking and management of your revenues and associated KPIs (churn, LTV, CAC, etc.) in real time, without the need for a data team or manual processing, thanks to direct integrations with your billing systems and ERP.

Unlike generic BI tools, Fincome offers a turnkey, intuitive solution tailored to the specific needs of subscription-based businesses, enabling seamless collaboration across your finance, GTM, and CSM teams.

Fincome is built exclusively for companies with recurring revenue models, meaning those that track MRR or ARR, such as:

• Software publishers (SaaS)

• Media companies

• Mobile apps

• Any other B2B or B2C subscription business looking to professionalize revenue management

Fincome supports organizations at every stage of growth, from startups to mid-market and large international enterprises.

With Fincome, you gain access to a full suite of modules:

✅ Revenue: detailed ARR/MRR breakdown, cohort analysis, detection of billing errors or omissions, revenue recognition and deferred revenue (PCA)

✅ Growth: analysis of ARR movements (new business, expansion, churn, reactivation), identification of growth drivers

✅ Unit Economics: LTV, CAC, and LTV/CAC analysis by segment, channel, or geography to optimize margins

✅ Retention: deep cohort analyses, identification of key retention drivers

✅ Renewals: future MRR projections, opportunity forecasting, and churn risk reduction

✅ Forecasting: revenue growth scenario modeling to better inform strategic decisions

Fincome is the only turnkey platform built specifically for recurring revenue businesses that combines:

✅ A complete, reliable view of your recurring revenues (MRR, ARR, churn, LTV, CAC, cohorts, renewals, revenue recognition, deferred revenue)

✅ Fully customizable, automated, shareable reports powered by AI, delivering actionable insights to guide your strategic decisions

✅ Expert support to help structure and interpret your analyses, without needing to build an internal data team

✅ The ability to generate future growth scenarios, compare them side by side, and track actual vs. forecasted performance, all in real time

Unlike traditional BI tools, which require you to build and maintain your own metrics (often consuming internal resources just to produce static data visualizations), Fincome transforms your SaaS metrics into concrete, actionable recommendations — helping you move faster, with more impact and operational efficiency.

Yes! If you use an unlisted or in-house billing system, no problem — you can easily import your billing data via Excel or push it through our public API. You can access our public API documentation here.

With Fincome, you can:

✅ Reduce up to 90% of the time spent calculating and reporting your KPIs

✅ Make faster, more accurate strategic decisions

✅ Recover up to 5% of lost revenue by detecting errors or omissions

✅ Cut the risk of manual spreadsheet errors by 80%

Absolutely. Data security is at the heart of what we do. Fincome is SOC 2 Type I certified, ensuring a high level of data security and protection.

Your data is collected exclusively via read-only APIs and hosted on secure servers located in France. We never share your data with third parties without your consent.

For a detailed review of our security practices, please visit our dedicated security page.

At Fincome, customer success is a core priority. We guide you from the very start — structuring your data, training your teams, and optimizing your use of the platform to deliver value quickly.

Our team remains by your side to answer strategic or technical questions, share best practices, and help you get the most out of your analyses.

Simply request a demo on our website. We’ll walk you through the platform, assess your needs, and guide you through a smooth deployment.

Most deployments and team trainings take no more than two weeks to get fully up and running.

👉 Request a demo

Income Analytics:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Budget Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Wealth Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.