Financial management for SaaS growth: a stage-by-stage guide

Navigating financial management in a SaaS company can feel overwhelming, especially as your business grows. From the early stages of securing recurring revenue to scaling operations, aligning your financial strategy with your business growth is crucial for long-term success. This alignment allows you to make data-driven decisions, optimize resources, and stay agile as you expand.

In this article, we’ll explore how to structure your financial management at different growth stages, from startup to scale-up, based on a webinar by Antoine Junger and Rémy Deloffre – two SaaS experts. We’ll also look at how you can leverage key SaaS metrics like ARR and MRR to guide your strategic decisions. Whether you're an early-stage startup or preparing for Series B funding, these actionable insights will help you create a robust financial management system.

Quick introduction of the speakers

Antoine Junger and Rémy Deloffre have extensive experience in financial management for SaaS businesses.

As Sales Manager at Fincome, Antoine works with SaaS clients with recurring revenue models to centralize and track their performance metrics, focusing on top-line indicators from MRR to cash flow. With over 100 clients, 95% of whom are SaaS companies, Fincome assists clients with ARR ranging from €500k to €50M, and has deep expertise in helping businesses monitor and forecast financial health efficiently.

A partner at Acting, Rémy brings 15 years of experience in financial consulting, investments, and helping startups structure their finances. Acting specializes in providing part-time CFO services to over 600 clients, many of which are SaaS companies. His expertise lies in ensuring that businesses scale sustainably while keeping their financial metrics in check.

Establishing a financial reporting foundation from the start

Every SaaS business starts small, but the sooner you establish a solid financial reporting foundation, the better you can manage growth. Early-stage SaaS businesses should prioritize building their financial infrastructure to track key metrics from day one.

Why tracking financial metrics from day one is essential

In the initial phases of a SaaS startup, setting up a robust financial reporting system is crucial. As Rémy highlights, the most important metric at this stage is ARR, which reflects predictable, recurring income. Establishing this early lets you clearly understand how your revenue streams will grow over time.

Key reporting metrics: ARR vs. traditional P&L

Rémy observes that as a SaaS, you’ll likely use two types of reporting:

- Traditional financial metrics, including profit and loss (P&L), EBITDA, and cash flow.

- SaaS-specific metrics, with ARR and MRR being the most critical.

ARR is the backbone for SaaS financial reporting because it represents your predictable income. To calculate ARR, take your MRR and multiply it by 12. It's important to distinguish between recurring revenue and non-recurring revenue, such as one-time onboarding fees or professional services.

As an example: If you issue a $12,000 invoice for an annual contract, your MRR would be $1,000 per month, and your ARR would be $12,000. Non-recurring revenues, such as a $3,000 setup fee, should not be included in the ARR calculation.

Best practices for revenue tracking

When it comes to tracking financial metrics:

1. Leverage a SaaS-specific billing tool: Use platforms to manage your billing efficiently. These tools are built to handle recurring billing models, ensuring that all your transactions are properly categorized as recurring or non-recurring.

2. Automate the flow of data: Ensure that your billing system integrates with your accounting software to avoid manual errors and to streamline reporting.

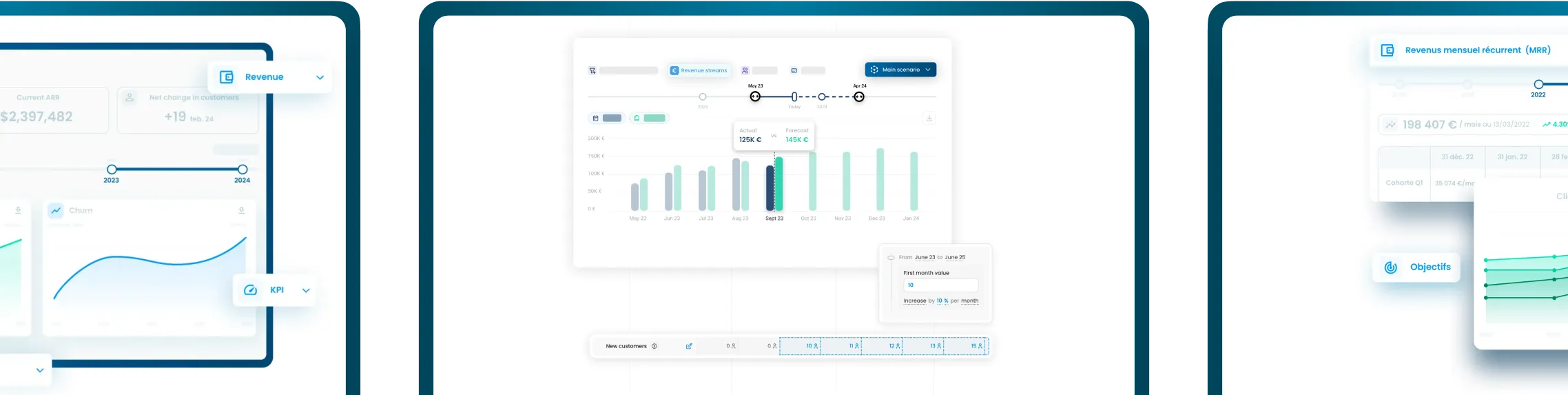

The following graph illustrates what accurate and complete reporting can look like:

Structuring and enriching financial data as you grow

As your company evolves, so should your financial strategy. Growth brings additional complexity, requiring you to structure and enrich financial data to maintain a clear view of your company’s performance. Tracking MRR and ARR alone is no longer enough—you need to segment and analyze the data for deeper insights.

Key performance indicators (KPIs) for revenue growth

For companies in the earlier stages of growth, the most critical KPIs derive from MRR or ARR. Antoine emphasizes that tracking the monthly movements in these metrics provides a snapshot of the company’s growth trajectory. This means tracking:

- New MRR/ARR: Revenue generated from new customer acquisitions.

- Upsell MRR/ARR: Additional revenue from existing customers upgrading their plans.

- Churn MRR/ARR: Revenue lost due to customers cancelling their subscriptions.

For instance, if your MRR was $20,000 in January and you added $5,000 in new customer subscriptions but lost $1,000 in churned accounts, your net MRR for February would be $24,000.

The ability to monitor these changes on a monthly basis helps SaaS teams quickly identify trends and opportunities for growth.

North star metrics for SaaS businesses

As your SaaS business grows, it’s crucial to define your “North Star metrics.” These are the key indicators that reflect your company’s overall health and growth potential. Investors, especially during fundraising rounds, will be laser-focused on these metrics to gauge your business's viability. Some of the most critical North Star metrics include:

- ARR Growth: Tracking ARR growth over time is essential, especially for SaaS companies preparing for a fundraising round. For example, if your ARR grows from $1 million to $1.5 million in a year, it signals a 50% year-over-year growth rate—a strong indicator of product-market fit and potential scalability.

- ARR per Employee: This metric evaluates how efficiently your company is growing relative to your headcount. If your ARR is $1 million and you have 50 employees, your ARR per employee would be $20,000. A higher ARR per employee indicates more efficient growth and scalability.

- NRR (Net Revenue Retention): This metric measures your ability to retain and grow revenue from existing customers. A good example is a company that has an ARR of $1 million at the start of the year and generates an additional $200,000 in upsells, but loses $100,000 due to churn. In this case, the NRR would be 110%, reflecting a healthy growth rate within the existing customer base.

- Rule of 40: This metric combines your growth rate and profit margin. If your ARR growth rate is 30% and your EBITDA margin is 15%, your Rule of 40 score would be 45, which is above the recommended threshold of 40 for SaaS companies and signals a healthy balance between growth and profitability.

These metrics help businesses communicate their performance clearly to stakeholders and make more informed strategic decisions.

{{discover}}

Refining financial data as your business reaches maturity

As SaaS businesses enter a more mature stage - typically around Series A or B - financial reporting becomes more complex. At this point, businesses should enrich their financial data with more granular KPIs reflecting their specific operational goals.

Customizing KPIs to reflect your business model

At this growth stage, you need to tailor KPIs to reflect the nuances of your business model. Antoine recommends going beyond standard KPIs like MRR and ARR and focusing on deeper metrics, such as:

- Revenue by product line: A SaaS business that offers multiple products or services can benefit from tracking ARR by product. For example, if one product generates $500,000 in ARR and another generates $300,000, this breakdown helps the company see which product contributes more to growth and whether resources should be reallocated.

- Revenue by geography: If you are expanding internationally, tracking revenue by country can provide insights into where your business is thriving. For instance, if your US operations generate $1 million in ARR while your European division generates $500,000, you might decide to invest more heavily in marketing efforts in Europe.

- Customer type: Segmenting your ARR by customer type - such as enterprise, SMB, or individual - allows you to analyze the most profitable segments. If enterprise customers contribute 70% of your ARR, but only make up 20% of your customer base, this could signal an opportunity to focus more on acquiring larger clients.

Customizing KPIs helps track performance more accurately and ensures that your company is allocating resources in the most effective way possible.

Aligning teams on key financial metrics

As SaaS businesses scale, Fincome teams have observed that misalignment between departments is a common issue. For instance, sales teams often rely on CRM data, while finance teams focus on billing reports, leading to discrepancies in key metrics. This lack of synchronization can result in conflicting performance insights, making it harder to make strategic decisions.

To address this, Antoine emphasizes the importance of integrating systems so that CRM, billing, and accounting tools communicate seamlessly. This approach creates a unified view of KPIs across all departments, ensuring everyone is aligned on strategic goals.

For example, if your sales team is focused on increasing MRR while your finance team prioritizes profitability, these objectives may clash. By aligning both teams on shared metrics like NRR, businesses can ensure that all departments work toward the same overarching goals, reducing friction and improving performance tracking.

Involving C-level executives and moving toward predictive financial management

Once a company reaches a certain level of growth, aligning C-suite executives on key financial metrics becomes vital. This alignment is necessary to shift from reactive to predictive financial management.

Engaging the entire C-suite

Each department within a SaaS company benefits from tracking financial metrics, and involving the C-suite ensures a company-wide understanding of performance:

- CEOs: Use KPIs to make strategic decisions around growth, capital allocation, and investor communications.

- CFOs: Rely on metrics to audit revenue, produce forecasts, and ensure financial stability.

- Go-to-market teams: Analyze KPIs like MRR by customer segment to identify growth opportunities and adjust pricing strategies.

- Customer success teams: Track NRR to measure retention and identify opportunities for upselling.

Moving toward predictive financial management

By aligning all teams on shared metrics, SaaS businesses can begin to shift toward predictive financial management. This involves using historical data to project future outcomes. For instance, analyzing sales pipeline data allows you to predict how many deals will close in the next quarter, giving you a clear view of future revenue.

Predictive financial management helps businesses anticipate challenges, seize new opportunities, and make proactive decisions that keep growth on track.

Effective financial management in a SaaS business involves adapting your strategy as you grow. From tracking essential KPIs like ARR and related metrics in the early stages to customizing financial metrics to reflect your business model, building a robust financial reporting system is key to scalable growth.

As your company matures, aligning teams on shared metrics and transitioning to predictive financial management will allow you to stay ahead of challenges and drive long-term success.

By following these steps, SaaS companies can ensure that their financial management strategy supports sustainable growth at every stage of their journey.

{{newsletter}}

Discover Fincome!

Frequently Asked Questions

Expense Tracking:

Fincome is a SaaS revenue management platform designed specifically for companies with recurring revenue models (any business selling subscriptions).

Fincome automates the tracking and management of your revenues and associated KPIs (churn, LTV, CAC, etc.) in real time, without the need for a data team or manual processing, thanks to direct integrations with your billing systems and ERP.

Unlike generic BI tools, Fincome offers a turnkey, intuitive solution tailored to the specific needs of subscription-based businesses, enabling seamless collaboration across your finance, GTM, and CSM teams.

Fincome is built exclusively for companies with recurring revenue models, meaning those that track MRR or ARR, such as:

• Software publishers (SaaS)

• Media companies

• Mobile apps

• Any other B2B or B2C subscription business looking to professionalize revenue management

Fincome supports organizations at every stage of growth, from startups to mid-market and large international enterprises.

With Fincome, you gain access to a full suite of modules:

✅ Revenue: detailed ARR/MRR breakdown, cohort analysis, detection of billing errors or omissions, revenue recognition and deferred revenue (PCA)

✅ Growth: analysis of ARR movements (new business, expansion, churn, reactivation), identification of growth drivers

✅ Unit Economics: LTV, CAC, and LTV/CAC analysis by segment, channel, or geography to optimize margins

✅ Retention: deep cohort analyses, identification of key retention drivers

✅ Renewals: future MRR projections, opportunity forecasting, and churn risk reduction

✅ Forecasting: revenue growth scenario modeling to better inform strategic decisions

Fincome is the only turnkey platform built specifically for recurring revenue businesses that combines:

✅ A complete, reliable view of your recurring revenues (MRR, ARR, churn, LTV, CAC, cohorts, renewals, revenue recognition, deferred revenue)

✅ Fully customizable, automated, shareable reports powered by AI, delivering actionable insights to guide your strategic decisions

✅ Expert support to help structure and interpret your analyses, without needing to build an internal data team

✅ The ability to generate future growth scenarios, compare them side by side, and track actual vs. forecasted performance, all in real time

Unlike traditional BI tools, which require you to build and maintain your own metrics (often consuming internal resources just to produce static data visualizations), Fincome transforms your SaaS metrics into concrete, actionable recommendations — helping you move faster, with more impact and operational efficiency.

Yes! If you use an unlisted or in-house billing system, no problem — you can easily import your billing data via Excel or push it through our public API. You can access our public API documentation here.

With Fincome, you can:

✅ Reduce up to 90% of the time spent calculating and reporting your KPIs

✅ Make faster, more accurate strategic decisions

✅ Recover up to 5% of lost revenue by detecting errors or omissions

✅ Cut the risk of manual spreadsheet errors by 80%

Absolutely. Data security is at the heart of what we do. Fincome is SOC 2 Type I certified, ensuring a high level of data security and protection.

Your data is collected exclusively via read-only APIs and hosted on secure servers located in France. We never share your data with third parties without your consent.

For a detailed review of our security practices, please visit our dedicated security page.

At Fincome, customer success is a core priority. We guide you from the very start — structuring your data, training your teams, and optimizing your use of the platform to deliver value quickly.

Our team remains by your side to answer strategic or technical questions, share best practices, and help you get the most out of your analyses.

Simply request a demo on our website. We’ll walk you through the platform, assess your needs, and guide you through a smooth deployment.

Most deployments and team trainings take no more than two weeks to get fully up and running.

👉 Request a demo

Income Analytics:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Budget Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Wealth Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.