Fincome, the alternative to spreadsheets for reliable, fast, and collaborative SaaS analytics & forecasting.

CFOs and SaaS founders often start out managing their finances in Excel. But the limits quickly become clear: unstable files, formula errors, manual consolidation, endless versioning, and clunky sharing…

Fincome automates your MRR tracking, KPIs, cash flow, and forecasts—so you can finally focus on decisions, not spreadsheets.

4.8 / 5 stars average on our customer reviews

1. In-depth analysis: unlimited slice & dice

Fincome provides a 360° view of your SaaS metrics—actionable monthly, quarterly, or annually—and fully segmentable :

MRR / ARR snowball: gain, reactivation, churn, upsell / cross-sell, downsell and price / volume effect.

CAC, CAC payback, ARPA, churn rate, NRR, LTV, LTV/CAC, SaaS Quick ratio, etc.

Detailed cohort analyses to accurately measure retention or growth overall or by segment

This data is available through interactive, filterable dashboards (by date, segment, or custom properties), allowing you to break down each KPI, isolate any subset with a single click, and export or share the relevant view effortlessly.

A solution designed to ensure reliability, bring structure, and save time.

Where Excel requires you to manually rebuild your metrics, Fincome generates them automatically from your billing data (Stripe, Chargebee, Sellsy…). You can audit every line, adjust your metrics to account for special cases (VAT, discounts, canceled invoices), and build an MRR that’s truly actionable—not just displayed.

You move from a manual, patchwork setup to a structured, scalable, collaborative environment. Formula errors disappear, file back-and-forths come to an end, and your decisions are finally based on reliable, up-to-date, and contextualized data.

Why switch from traditional spreadsheets to Fincome?

Many SaaS companies start by tracking their business with a spreadsheet (Excel, Google Sheets…). But very quickly, the “DIY” approach hits its limits. As data volume grows, reporting becomes unstable—and sometimes even risky. Every new export requires manual rework, and each monthly report rests on a fragile stack of files.

With Fincome, all your data is centralized, automatically processed, segmented, and ready to analyze. No more juggling ten versions of the same file. You track your KPIs in real time, build forecasts on solid foundations, and share insights without ever wondering if you’re looking at the right version.

2. Forecast scenarios

Fincome Forecast streamlines modeling your recurring revenue. With just a few clicks, you can build growth scenarios, validate your assumptions, and adjust your trajectory in real time —giving you the visibility, agility, and confidence to make smarter decisions.

You can generate a baseline revenue growth scenario and then develop downside and upside cases by tweaking one or more underlying assumptions.

3. Custom reports

With Fincome, effortlessly generate fully personalized reports tailored specifically for your Sales, Marketing, CSM, and Finance teams. Customize each report to align with your brand identity—adding your logo, corporate colors, and unique analyses.

Easily share insightful reports internally or with investors, and set up automatic, scheduled deliveries to predefined recipient lists, keeping everyone consistently informed.

4. More than self-service—expert guidance from day one

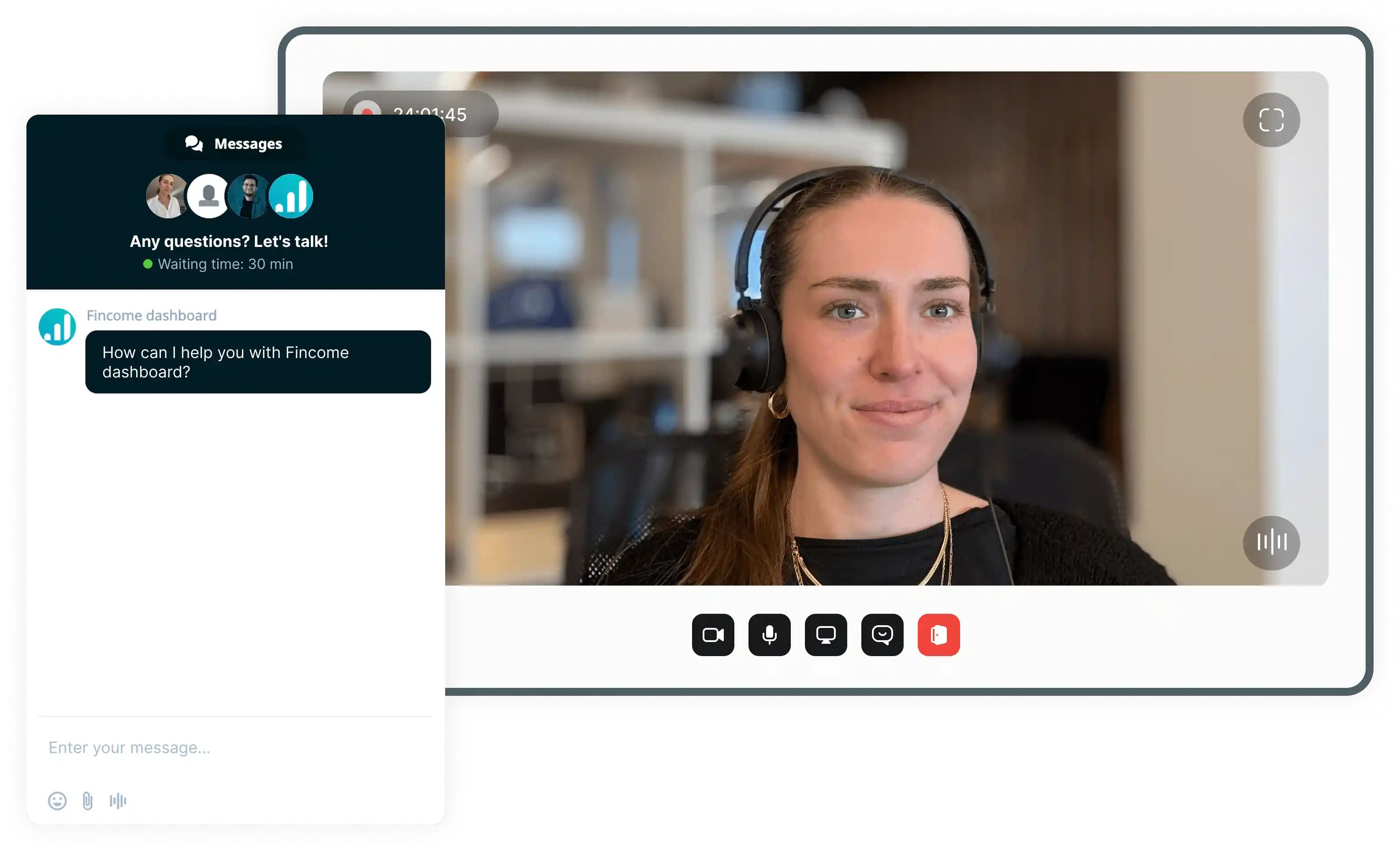

Unlike traditional self-service solutions, Fincome provides dedicated, hands-on support from the very beginning.

Our expert team ensures rapid, tangible results by aligning your data with your ARR records, onboarding your teams to master key SaaS metrics, unlocking powerful segmentation capabilities, crafting tailored reports, and building precise forecasting scenarios. With Fincome, SaaS specialists support you at every milestone of your journey.

5. Transform your data decisions with conversational AI

At Fincome, we’re revolutionizing how Finance and Revenue teams interact with and leverage their data using cutting-edge conversational AI.

With our intelligent chatbot, effortlessly engage in natural dialogue to instantly access personalized, insightful, and directly actionable reports.

Our proactive anomaly detection feature automatically identifies unusual data patterns and KPI deviations, immediately suggesting targeted corrective actions.

Additionally, our enhanced generative forecasting module intelligently automates the creation of optimized forecast scenarios, seamlessly integrating external factors like seasonality, promotions, or regulatory impacts.

With these innovations, Fincome delivers next-generation intelligent analytics—driving smarter, strategic decisions and superior financial performance.

With Excel, you gather your numbers. With Fincome, you drive your strategy.

Octime’s challenge: moving beyond Excel and securing reliable performance management

Octime, a fast-growing HR SaaS provider, needed to structure its financial management in response to increasingly complex pricing models, multi-site clients, and varied billing cycles.Before 2021, Octime didn’t have a structured management control process. Analyses were done “the old-fashioned way” in Excel—using outdated dashboards, flat data exports, and limited consolidation tools.

With Fincome, Octime reached a new level: MRR is now reliable, KPIs have been refined to account for specific business cases, forecasts are easily adjustable, and the team has a clear multi-segment view. Today, Octime operates with a robust financial cockpit—built to support strategic decision-making.

“I used to export data, do a snapshot every month, archive it, and try to rework everything in Excel files.”