The benefits and limitations of Google Sheets for finance

In business, the first reflex for management is to use a spreadsheet. Although the use of Google Sheets or Excel for finance is fairly widespread, it's not always ideal. In this article, you'll discover the advantages and limitations of these tools, as well as the alternative solutions available to you.

1 - Why use Google Sheets or Excel for financial management?

Whatever the size of the company and the skills available in-house, financial teams and management alike have a spreadsheet program at their disposal, whether it's Microsoft Excel or Google Sheets. They remain essential management tools with many practical benefits, even if they are not always the ideal solution.

1.1 - Low-cost spreadsheets accessible to all companies

For calculations with simple or advanced formulas, data tables, or long-term management analysis, the Excel spreadsheet is often the go-to solution in finance. These spreadsheets are available free of charge or for the modest price of a few euros a month. They come with the Microsoft 365 office suite or Google Workspace (formerly known as GSuite).

It is also possible to download free Excel templates for finance such as:

• calculations of loan instalments, broken down into principal and interest (according to term and rate);

• a depreciation schedule for an investment;

• a business plan with all assumptions translated into financial data, etc.

1.2 - Excel and Google Sheets as flexible financial tools

Whatever your needs, the Excel sheet or workbook can do the job, provided you've mastered the formulas, advanced functions, as well as macros or even the VBA programming language. It's a flexible tool that adapts exactly to your company, its business, its products, and their analysis. In fact, that's the whole point of a spreadsheet.

1.3 - Excel and Google Sheets are used worldwide

Another advantage of these management tools is that all companies can use them. It's easy to communicate files to partners such as the bank, the chartered accountant, the statutory auditor, the credit insurance company, and so on. Whatever the function, your contacts are generally able to read and use data in these formats.

{{discover}}

2 - What are the limits of Google Sheets or Excel for finance?

Even if you have a management controller who's an expert in Excel for finance, using such a spreadsheet can quickly slow you down. To overcome them, the user has to spend a lot of time and energy that could have been devoted to data analysis and the best SaaS KPIs.

2.1 - The Excel spreadsheet is a manual tool with risks

Google Sheets or Excel for finance are still spreadsheets, and therefore blank sheets that have to be filled in manually. You have to create everything from scratch. This is time-consuming, especially for complex tables with multiple sources of information, such as an income or cash flow statement. What's more, automated updating is impossible: a human must copy and paste in new values. As for automated importing of external data, this can prove tricky.

Excel users in finance handle basic formulas and functions such as sorting, filtering, pivot tables, and so on. In addition to being time-consuming, these spreadsheets are a source of risk. Indeed, a complex file requiring a lot of manual input results carries a high risk of error, as data may entered incorrectly, wrong formulas may be used, or formulas may be entered into the wrong cells, etc.

They demand tighter controls to limit errors. This is another waste of time, as well as a significant source of stress.

2.2 - Google Sheets and Excel have limited capacity and data processing capabilities

As the company grows and the data to be processed becomes more extensive, both Google Sheets and Excel prove unsuitable. These spreadsheets are limited in the volume of information they can process. For example, there is a maximum number of columns and rows. In addition, processing times can become very long due to insufficient computing power.

2.3 - Google Sheets and Excel: not very collaborative spreadsheets in practice

Both Microsoft and Google are now touting the collaborative aspect of their Onedrive solutions via Sharepoint or Drive. In practice, however, file sharing between multiple users remains complex. For reasons of traceability of modifications and file ownership, we advise against several members of a finance team working on the same Google Sheets or Excel file at the same time. There's nothing easier than overwriting important data or making formula errors when working on a file you can't truly master until you’ve developed your skills through courses in the advanced functions.

2.4 - Lack of traceability in Microsoft and Google spreadsheets

These tools lack one vital function—they have no real audit trail. As a result, it remains complicated to tack changes made to Excel files or Google Sheets file, even if you can access previous versions. Depending on the complexity of the files, these functions may become insufficient.

2.5 – Google Sheets and Excel require at least some training

As soon as you go beyond a data table with basic functions, the use of these spreadsheets requires users to take a course to learn the skills they need to master advanced functions. For the finance team, it is possible to produce complex financial models and statements. However, this requires a detailed understanding of both the mechanics of finance and the skills to model them in a spreadsheet. Novices usually need to take a course, or perhaps several courses, to learn the skills to make this approach truly effective.

3 - What are the alternatives to Excel for finance?

Whether you're looking to use a sophisticated financial function or automate a management dashboard, other tools exist for corporate finance. Often available as SaaS solutions, they address the shortcomings of spreadsheets such as Excel and Google Sheets.

3.1 - Excel for finance: a relevant tool only for VSEs

As companies grow and generate large volumes of data from a variety of information sources, Excel is no longer sufficient. In the end, only very small businesses find these tools practical and flexible for getting started.

3.2 - BI (business intelligence) available to all companies

Even if your finance teams have solid training in Excel, or even certifications, their job is not to design and make reliable tables. Use them for higher value-added tasks. That's where business intelligence (BI) solutions come in for data collection, analysis, and presentation. BI solutions are now widely available, particularly to SaaS providers.

Note that BI also requires specific skills (data processing, cleaning, and formatting). You start with a blank sheet of paper and build your dataset and reporting from there.

3.3 - Fincome, the automated financial reporting platform for SaaS providers

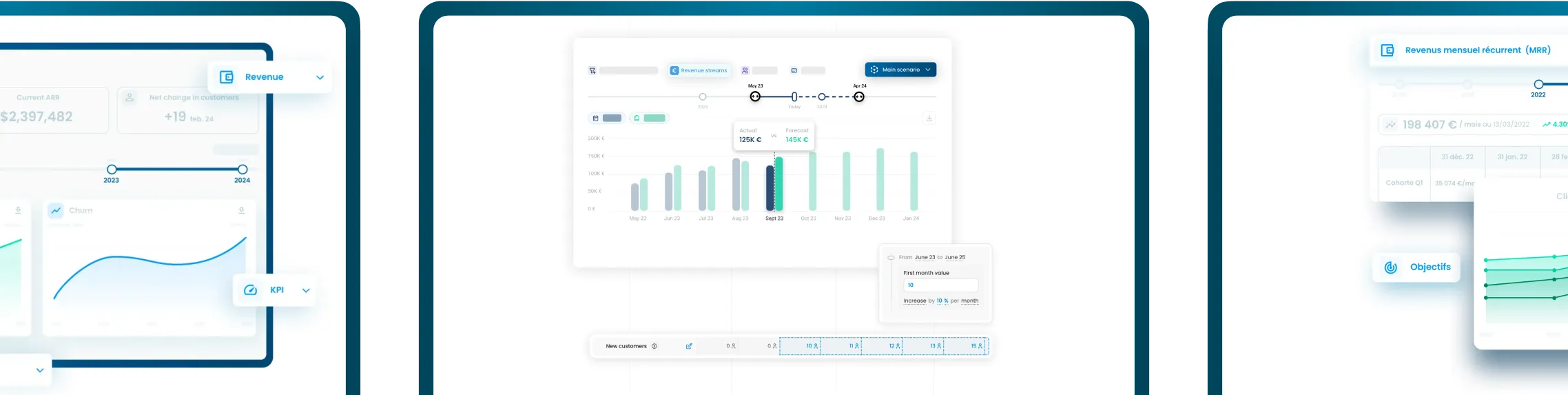

Why waste time using Excel for your SaaS finance when a turnkey platform automates all the KPI calculations essential to your business? With Fincome, you benefit from comprehensive financial reporting designed specifically for businesses with recurring revenues.

With our online financial management solution, you can focus on analysis, not on building and checking indicators in Excel.

Book a demo to discover why our solutions beat Excel for financial reporting.

💡 Complete your reading with the following articles:

- 3 common mistakes that kill SaaS startups

- Top tips for communicating with SaaS investors

- Automated reporting for SaaS: a quick guide

- KPI reporting at every stage of your startup

- Why is SaaS financial reporting still crucial for your startup in 2023?

{{newsletter}}

Discover Fincome!

Frequently Asked Questions

Expense Tracking:

Fincome is a SaaS revenue management platform designed specifically for companies with recurring revenue models (any business selling subscriptions).

Fincome automates the tracking and management of your revenues and associated KPIs (churn, LTV, CAC, etc.) in real time, without the need for a data team or manual processing, thanks to direct integrations with your billing systems and ERP.

Unlike generic BI tools, Fincome offers a turnkey, intuitive solution tailored to the specific needs of subscription-based businesses, enabling seamless collaboration across your finance, GTM, and CSM teams.

Fincome is built exclusively for companies with recurring revenue models, meaning those that track MRR or ARR, such as:

• Software publishers (SaaS)

• Media companies

• Mobile apps

• Any other B2B or B2C subscription business looking to professionalize revenue management

Fincome supports organizations at every stage of growth, from startups to mid-market and large international enterprises.

With Fincome, you gain access to a full suite of modules:

✅ Revenue: detailed ARR/MRR breakdown, cohort analysis, detection of billing errors or omissions, revenue recognition and deferred revenue (PCA)

✅ Growth: analysis of ARR movements (new business, expansion, churn, reactivation), identification of growth drivers

✅ Unit Economics: LTV, CAC, and LTV/CAC analysis by segment, channel, or geography to optimize margins

✅ Retention: deep cohort analyses, identification of key retention drivers

✅ Renewals: future MRR projections, opportunity forecasting, and churn risk reduction

✅ Forecasting: revenue growth scenario modeling to better inform strategic decisions

Fincome is the only turnkey platform built specifically for recurring revenue businesses that combines:

✅ A complete, reliable view of your recurring revenues (MRR, ARR, churn, LTV, CAC, cohorts, renewals, revenue recognition, deferred revenue)

✅ Fully customizable, automated, shareable reports powered by AI, delivering actionable insights to guide your strategic decisions

✅ Expert support to help structure and interpret your analyses, without needing to build an internal data team

✅ The ability to generate future growth scenarios, compare them side by side, and track actual vs. forecasted performance, all in real time

Unlike traditional BI tools, which require you to build and maintain your own metrics (often consuming internal resources just to produce static data visualizations), Fincome transforms your SaaS metrics into concrete, actionable recommendations — helping you move faster, with more impact and operational efficiency.

Yes! If you use an unlisted or in-house billing system, no problem — you can easily import your billing data via Excel or push it through our public API. You can access our public API documentation here.

With Fincome, you can:

✅ Reduce up to 90% of the time spent calculating and reporting your KPIs

✅ Make faster, more accurate strategic decisions

✅ Recover up to 5% of lost revenue by detecting errors or omissions

✅ Cut the risk of manual spreadsheet errors by 80%

Absolutely. Data security is at the heart of what we do. Fincome is SOC 2 Type I certified, ensuring a high level of data security and protection.

Your data is collected exclusively via read-only APIs and hosted on secure servers located in France. We never share your data with third parties without your consent.

For a detailed review of our security practices, please visit our dedicated security page.

At Fincome, customer success is a core priority. We guide you from the very start — structuring your data, training your teams, and optimizing your use of the platform to deliver value quickly.

Our team remains by your side to answer strategic or technical questions, share best practices, and help you get the most out of your analyses.

Simply request a demo on our website. We’ll walk you through the platform, assess your needs, and guide you through a smooth deployment.

Most deployments and team trainings take no more than two weeks to get fully up and running.

👉 Request a demo

Income Analytics:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Budget Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Wealth Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.